Hamstrung by their FP&A system’s failure to handle explosive growth and diversification, an insurance firm teamed with Armanino to access granular data and slash forecasting and reporting timelines.

The insurance entrepreneurs of Baldwin Risk Partners, LLC (BRP) deliver peace of mind to individuals and companies through tailored insurance and risk management solutions.

Obstructed by rapid growth and business complexity, BRP struggled to access their Workday Adaptive Planning software’s powerful features to provide data vital to forecasting and decision-making.

BRP harnessed Armanino’s cross-functional FP&A team to customize their Workday Adaptive Planning capabilities, aligning regional leaders with market-specific data and increasing financial insight.

With automated financial reporting, multi-year forecasting and live executive dashboarding, BRP now has the tools to enable strategic M&A.

Imagine your executive finance team hunched over a conference table as the accounting cycle closes, struggling to pull usable data from 20 different sources in time to make critical decisions about pressing merger and acquisition (M&A) deals. That was the month-end stress Keith Enright, (former) director of finance, and his team at BRP encountered with cumbersome integration/standardization issues.

As a publicly traded national distribution holding company specializing in holistic risk management, BRP has over 4,000 employees and engages more than 2 million clients. While adding 36 partnerships to their $400 million revenue base, BRP realized their FP&A software was inadequate for the business’s growing volume and complexity.

Working on an accelerated timeline, BRP implemented Workday Adaptive Planning to gain the timely and specific data needed for informed forecasting and M&A strategy. But, although the business embraced the high-level concept for financial transformation, executing that vision wasn’t so simple.

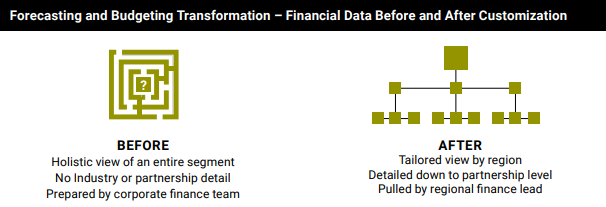

BRP’s rapid growth and increasing complexity kept the finance team from capitalizing on Workday Adaptive Planning’s full potential. Being short on needed techniques and tools to customize the new system and having no workable implementation plan meant they had limited access to essential financial data required for competitive strategies.

Deficient in data reporting availability and specificity, the off-the-shelf software instance limited BRP’s ability to optimize the data at hand and put it into the hands of decision makers efficiently.

It was time to find the right team with the necessary FP&A expertise and experience with Workday Adaptive Planning to tailor the financial system to BRP’s exact needs and bring their vision to reality.

Needing quick help, BRP called a previous consulting firm. That firm recommended Armanino for their experience in customizing Workday Adaptive Planning and their ability to scale resources up or down as the project dictated through outsourcing.

“Our request of Armanino was short, but not simple — help us execute on a financial transformation vision for which we have no roadmap or processes currently in place,” says Enright. “The Armanino team jumped in as thought partners, problem solvers, architects and business analysts to do just that.”

Armanino’s CFO Advisory consultants led the brainstorming process, beginning with probing questions about the desired end state and reverse engineering to determine the architecture and system support BRP required to achieve its vision. This discovery process revealed a need for detailed forensic accounting to dive in and analyze ongoing operational expenses (OpEx) and vendor relationships.

The Armanino Strategic Finance Outsourcing team stepped in and provided this expertise, developing OpEx reporting from scratch. BRP studied the new OpEx database to examine spending and relationships between regions to untangle critical staffing and service metrics. Ultimately, this research led to better KPI reporting and targeting benchmarks.

As a publicly held company, BRP must provide stakeholders with multiple-year forecasting based on consistent data. Having easy access to accurate and meaningful data allows BRP to pivot as a business whenever necessary.

Before Armanino stepped in, BRP could only do single-year aggregate annual budgets. Now, with the changes to Workday Adaptive Planning, they can update every quarter and eventually project a five-year rolling forecast at a granular level. “Armanino really saved the day on that forecasting,” says Enright.

The Armanino team performed the daily FP&A tasks while creating Adaptive enhancements, KPI templates and other tools.

Establishing such a robust financial reporting system had a domino effect, yielding countless downstream benefits. With a few keystrokes, each division, market segment and region can pull current and historical data regardless of the complexity and diversity of the company. Multiple associates at all company levels now use the financial reporting system, dashboards and KPI templates.

During the 15-month collaboration, BRP more than doubled its revenue, growing from $400 million to over $1 billion. Armanino’s updates and customization of Workday Adaptive Planning delivered the roadmap and tools for BRP to reach their financial vision to decentralize finance and maximize analytics.

“We are proud to say that we delivered on the financial transformation vision, and we have Armanino to thank for helping get us there,” says Enright.

Rolling forecast models furnish executives with essential financial information for decisive action on M&A transactions. Enhanced service modeling drives productivity gains for the company’s four distinct business models: Insurance Advisory Solutions, Legacy Mainstreet, Mortgage & Real Estate, and Medicare.

Creating OpEx reporting revealed spending patterns, regional relationships, and key staffing and service metrics, simplifying forecasting and incorporating GAAP and non-GAAP financial reporting. Automated and standardized financial reporting and KPI templates save time by eliminating labor-intensive manual data collation.

As business segments change, BRP will refresh the models. Armanino will continue assisting BRP with system enhancements, updates and additional software training as required.

“Armanino is very knowledgeable, flexible and technical. They were not afraid to roll up their sleeves and dive into the growing, evolving environment we had going on,” says Enright. “They are courageous in an accounting and finance way, working as thought partners and leaders alongside us.”

If you struggle with obtaining timely, accurate and detailed data or reducing manual tasks to streamline reporting, it’s time to think about modernizing your financial planning and analysis system. Gain the tools you need for forecasting and reporting. Contact our cross-functional team of FP&A experts to learn more about how to build an FP&A infrastructure that enables your organization’s growth.