The financial planning and analysis (FP&A) function includes some of the most critical business processes in any enterprise. However, FP&A is also an area where increasing complexity and organization growth can wreak havoc on the efficiency and effectiveness of the finance team. Hence the pressure many finance leaders face to transform FP&A for greater responsiveness, alignment with the business and strategic focus.

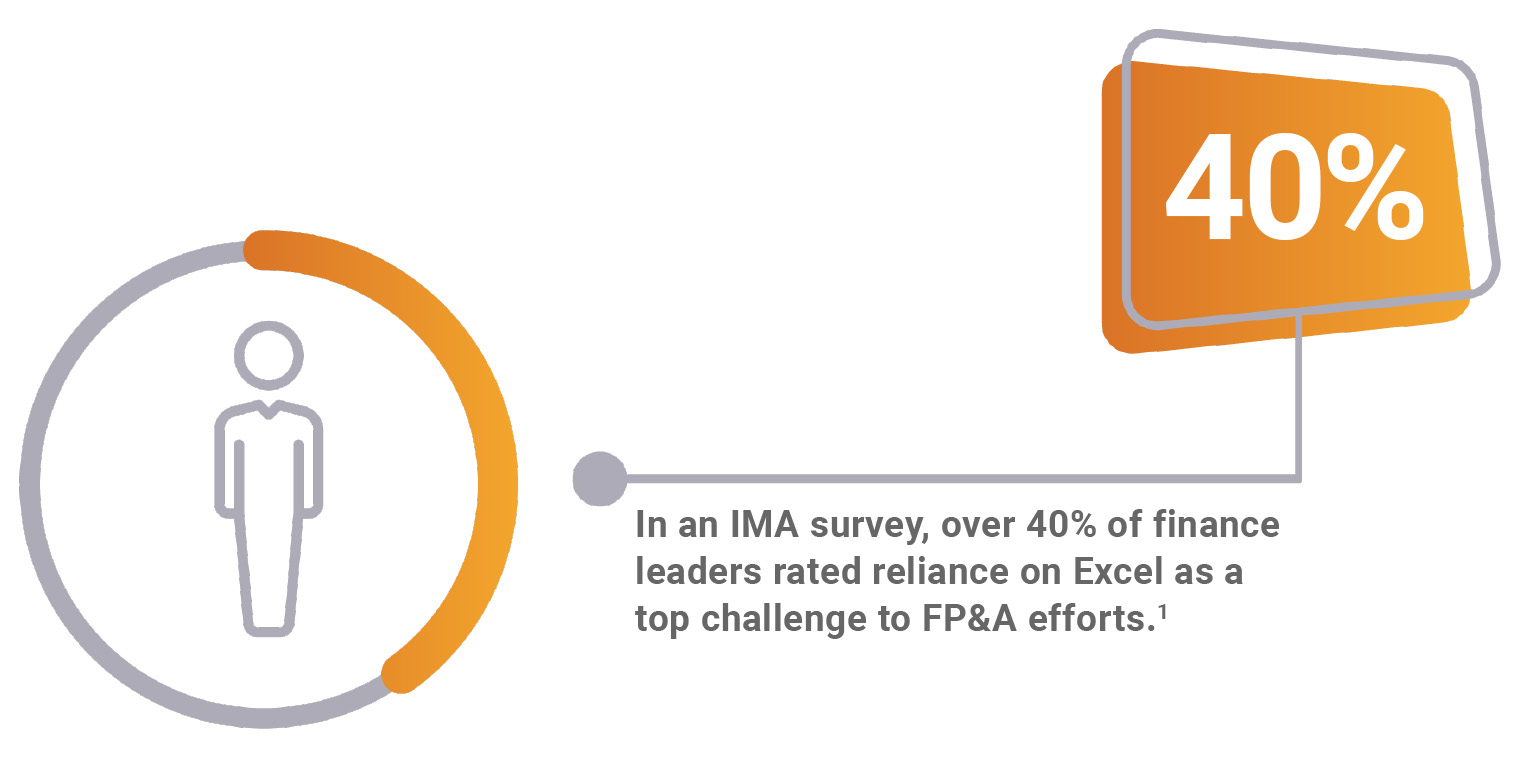

Indeed, transformation is imperative for many enterprises with decentralized entities and divisions, multiple accounting systems or a shortage of standardized processes. The traditional tool of choice — Excel spreadsheets — lacks the collaboration capabilities, controls and speed to deliver timely insights.

This reality is a barrier to company performance improvements because leaders aren’t able to assess options, see ahead of business changes and make informed decisions. The accelerating speed of change across enterprise-scale organizations increases the urgency to transform FP&A leadership.

The good news? While change is never easy, there is a way to reduce complexity, improve access to company performance data, streamline the planning and forecasting process and gain consistency across your organization. Let’s look at the challenges and pressures of the FP&A team within growing enterprises and how finance leaders can embark on transformation that delivers rapid, incremental results.

The FP&A team has an important role to play in the organization. But as your company grows and the pace of change accelerates, the responsibilities of the finance team become increasingly complex. Additionally, with the rise of artificial intelligence (AI) in FP&A, it is important for these teams to stay ahead of emerging trends and innovations to maintain a competitive edge.

Often, the FP&A function is stymied by the complexities and inconsistencies created by company mergers and acquisitions and organic growth, including:

The budgeting and planning process can be a particularly painful area for enterprises with decentralized divisions and entities. Depending on whether it’s a top-down, bottom-up or hybrid approach to budgeting, the current process often includes emailing one or more spreadsheets to dozens of people around the company.

Divisions or entities fill in their numbers (some adding lines for detail that break links) and send the spreadsheet back to be consolidated. This process requires significant manual effort without adding value and lacks an audit trail and role-based access controls. Adjustments and what-if analyses can take hours or days of additional number crunching and consolidation.

Regardless of how your enterprise evolved to its current state, the result is the same. Without automated, standardized and efficient processes, your FP&A function is severely limited in its ability to provide real-time performance data back to the business for informed and timely decision making.

Now imagine an FP&A function that is more effective and efficient — one that can respond quickly to the changing needs of your organization, while staying aligned with the company’s strategic direction. By embracing a software-driven FP&A transformation, enhanced by AI, finance teams can unlock new levels of agility, insight and performance.

FP&A transformation delivers:The process of transformation doesn’t have to be painful, lengthy or exorbitantly expensive.

Transformation can sound like hard work and a long wait for a payoff. But it doesn’t have to be that way when you have the right roadmap — and guidance — to help you on your journey.

The key to the roadmap is that it’s designed to provide real benefits that are delivered at regular intervals on your path to a transformed FP&A function. At each point during the journey, you gain new efficiencies and capabilities that drive value for the business. There’s no need to wait 12 or 18 months for results when you can implement incremental change and reap additional benefits every few months as you transform one part of the FP&A function after the next.

The roadmap strategy needs to take people, processes and technology into consideration as core components of the transformation. Working with an experienced advisor can help you address these areas holistically.

Creating the foundation for transformation also takes the right technology solution. That’s where the cloud comes in.

Today’s cloud-based, software-as-a-service (SaaS) solutions let you deploy new technology quickly and easily — without major upfront investments or lengthy IT implementation projects. That makes cloud-based software ideal for transforming FP&A one step at a time. You can roll out new capabilities incrementally as you redesign processes, adding value at each point on your roadmap.

Plus, modern cloud-based software increasingly embeds AI into the solution to enhance functionality and performance. These AI capabilities help finance teams uncover insights faster, reduce manual effort and fuel smarter, data-driven decisions.

Cloud-based software also lets you adapt more quickly and easily as your company grows and changes. You won’t get to the end of a long software implementation only to realize that your needs have changed in the meantime. With cloud-based software and AI enhancements delivered seamlessly multiple times per year, your FP&A function becomes scalable and smarter over time without disruption or added effort.

With the right cloud-based FP&A solution, you can:Choosing the right technology is essential when moving your organization forward. You want to ensure that your software aligns with your organization’s goals and meets the needs of stakeholders. Using the best applications possible to manage your FP&A process can be the difference between a competitive advantage and a blurry view of your organization’s health.

Identifying the best strategy and technology to transform your FP&A function can be daunting, but the right partner can make all the difference. Armanino has helped thousands of organizations build and execute a roadmap for success. Learn more about how to evolve your FP&A and find out how our award-winning FP&A software experts can help you elevate your FP&A function to deliver true value to your organization.

Download White Paper1 ”Overcoming FP&A’s Biggest Challenge: Predicting the Future,” Institute of Management Accountants, 2021.

2 “Top 4 Data & Analytics Trends in Finance,” Gartner, 2021.

If you have any questions or just want to reach out to one of our experts, use the form and we'll get back to you promptly.