You know the adage “the shoemaker’s children go barefoot,” referring to experts who are so invested in helping others that their own house goes unattended? As a family office CFO, do you feel like this applies to your situation? You’re working for individuals who were masters at building private wealth, but they don’t know how to efficiently oversee what they have today.

Families may not change quickly, but technology and business practices evolve at a speed that makes it hard to keep up. While wealth owners trust you to grow and protect their assets, prioritize business matters and manage risk, they might be mired in antiquated thinking that could be hindering your progress.

TABLE OF CONTENTS

Consider some common challenges:

These roadblocks are warning signs that it’s time to rethink your infrastructure. Here’s a look at what you might need to overcome to create a future-ready family office that helps you succeed in your role and solve the unique problems wealthy families face.

Many family offices have weak organizational structures, which can hinder progress for you and your team. In our consulting work, we often see common threads that indicate it’s time for an org chart adjustment to help drive needed change:

Generational changes are looming, but traditional family office leadership and process changes are slow. You face the demands of up-and-coming wealth owners who are far more technologically sophisticated than their parents and grandparents. They expect better technology and want agile leadership to bring efficiency and order to the organization, especially as the transfer of wealth gets more complex.

Modern investments, compliance and estate plans require more sophisticated technology and systems for speed, accuracy and efficiency. However, many family offices are still using old tools, like QuickBooks or Excel, sometimes mixed with some newer software to help with tasks like portfolio management. This reliance on outdated tools and piecemeal products is hampering decision-making, accuracy and efficiency.

While these may be obvious roadblocks, they’re not always enough to convince your family office leadership to modernize. Two main obstacles keep wealth owners from embracing needed change:

Working with outdated, on-premises accounting solutions and poor-quality data can open your family office to cybersecurity threats and fraud, as well as accounting, investment and tax mistakes:

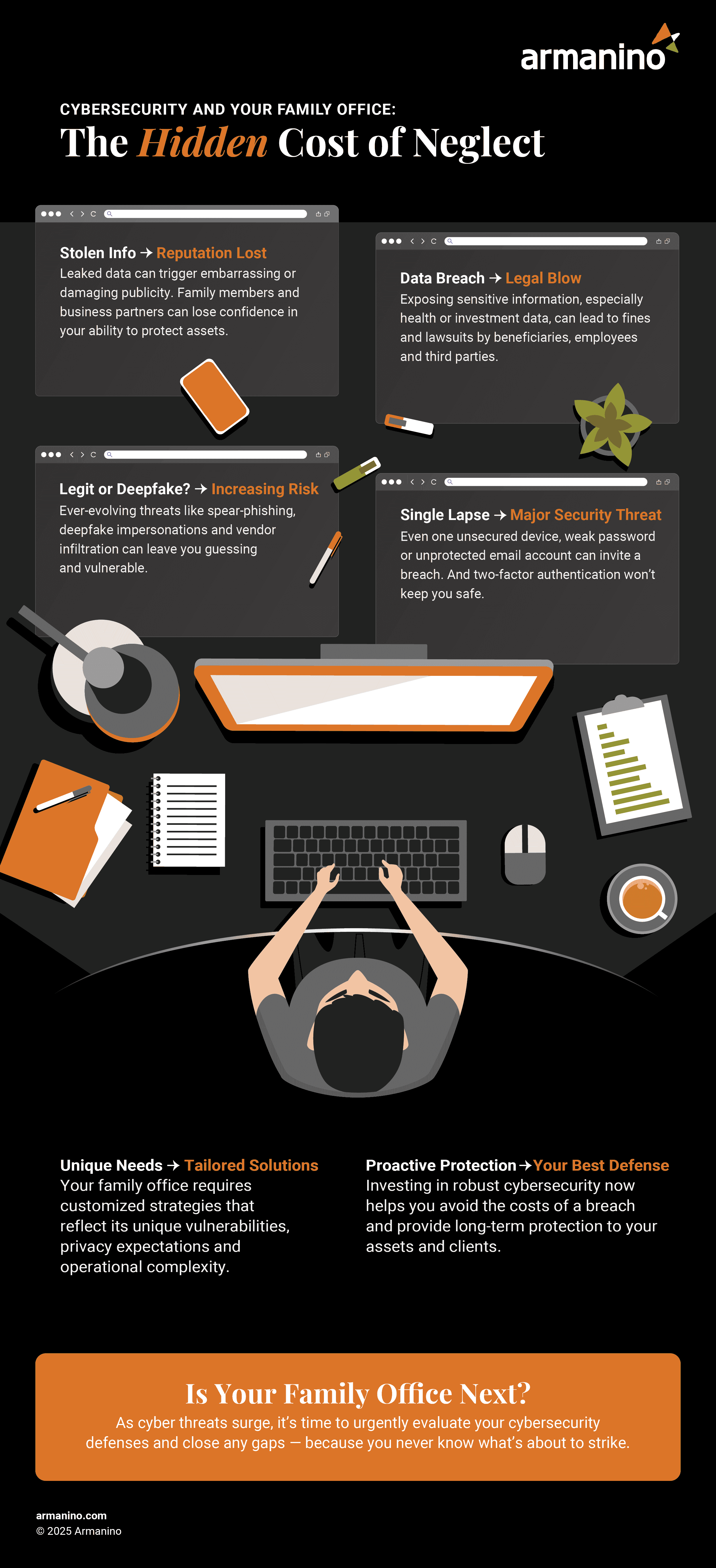

The frequency and sophistication of cybercrime keeps accelerating. Family offices, seen as high-value targets, are anything but safe — with 25% of North American family offices suffering a cyberattack in 2024, according to a survey by global law firm Dentons. The graphic below illustrates how weak cybersecurity can exact a high toll.

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

Here are some initial considerations as you build a modern family office:

With a more structured office, you may need to hire for executive roles, such as your CIO, operations manager and legal counsel. These leaders can help you provide strategy, perform value-driven tasks and oversee employees. For more complex, specialized or seasonal functions, such as accounting, human resources and fund administration, outsourcing is another smart option to consider.

Embrace the opportunity to present fresh, innovative approaches to running your family office. Start small with a tool or process that shows immediate value. A perfect example: Show your wealth owners how robotic process automation (RPA) can speed up reconciliations.

You may have hundreds of bank accounts that need to be reconciled on a daily or weekly basis. On average, this takes a person about 30 minutes per account, but an accounting bot can do the same task in 90 seconds. That can add up to a lot of hours per week saved by RPA. Seeing that kind of speed and efficiency typically moves the needle on change.

Family data, such as financial records, could be stolen if you don’t have proper data security measures in place. Now is a great time to identify where you might have weaknesses in your technology, processes and training.

Outdated systems can expose your family office to unnecessary risk. Ensure your systems such as accounting and financial planning software secure data. Many modern tools also flag discrepancies and data errors in bank reconciliations, further protecting your wealth owners’ assets and identities.

If you’re fighting a losing battle with outdated technology, org structure gaps and data security vulnerabilities, it’s time to consider a makeover. Find out how our family office experts can help you build and execute a smart people and technology strategy that makes your team more effective and efficient.

Maximize your day with industry-leading support. Reach out to our team to explore how we can help you streamline your family office and build wealth.