The number of ESG (Environmental Social Governance) frameworks is overwhelming. How do you know which is best for your company and stakeholders? In this guide, we discuss the basics of ESG frameworks – what they are, the different types available, their importance, and the steps necessary to select a framework.

Table of Contents

ESG frameworks (also referred to as standards or guidelines) provide organizations with a structure for planning, measuring, and reporting upon ESG initiatives. They simplify the ESG reporting process by highlighting key factors organizations should focus on and measure. These frameworks include standards or goals that can be used to gauge effectiveness of an ESG strategy and highlight what should be included with ESG disclosures

There are a few different types or categories of frameworks that organizations can choose from depending on their needs, goals, and potential requirements. We review assessment, reporting, disclosure, and scoring frameworks below.

Assessment frameworks are used most often to evaluate materiality or risk up front as part of ESG strategy. Some ESG consulting firms have even developed their own assessment frameworks.

ESG assessment framework examples include the B Impact Assessment and S&P Global Corporate Sustainability Assessment (CSA).

Reporting frameworks (also sometimes referred to as voluntary or guiding frameworks) are used to guide organizations in ESG strategy and reporting efforts by outlining standards or benchmarks to consider. Most of the time when you hear “ESG framework,” “reporting” is the implied context. Many organizations use these frameworks to help develop their ESG strategy and measure their success. ESG scores are typically not included within these frameworks.

ESG reporting framework examples include GRI and UN SDG. See our Top ESG Reporting Frameworks comparison below for more examples.

Disclosure frameworks (also referred to as governance or regulatory frameworks) are reporting frameworks that additionally guide business compliance with ESG regulations and requirements. Currently, the US does not require disclosure. However, some countries do have requirements. See ESG Disclosure Regulation for details.

For example, the European Union (EU) utilizes the SFDR (Sustainable Finance Disclosure Regulation) framework, and Australia uses the NGER (National Greenhouse and Energy Reporting) framework. Some additional ESG disclosure framework examples include GRI, SASB, and TCFD.

Scoring frameworks assist ESG benchmarking through measurable ratings. Many of the frameworks included in this category provide scorecards or ratings after an ESG assessment or survey is completed. These metrics are then used to benchmark organizations against others and can be disclosed with reports as ESG scores.

ESG scoring framework examples include CDP and S&P Global.

Some ESG frameworks combine the types mentioned above. For example, GRI and TCFD are both reporting and disclosure frameworks. CDP is an assessment, reporting, disclosure, and scoring framework. B Impact and S&P Global are both assessment and scoring frameworks. Keep this in mind when selecting an ESG framework best for you.

Frameworks are vital to help you navigate the complex realm of ESG.

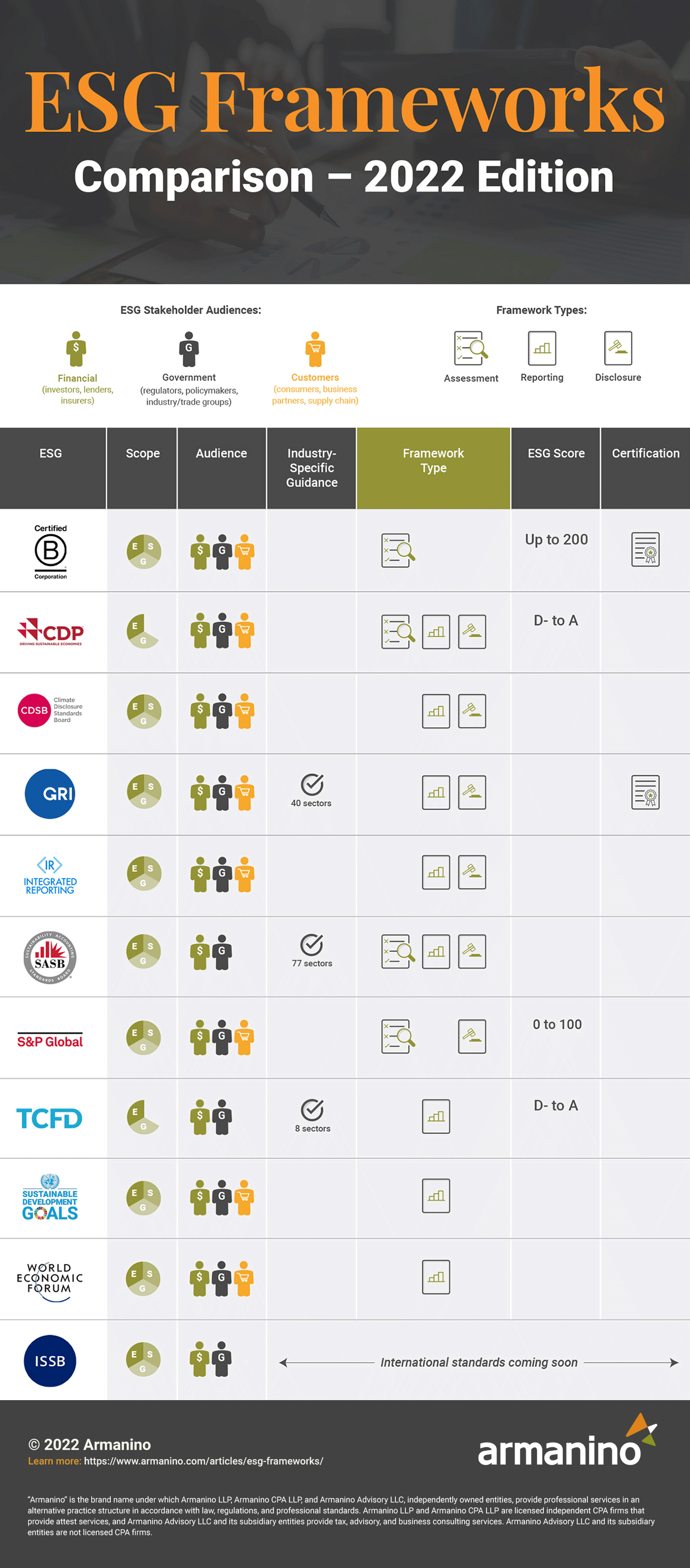

Here’s our high-level comparison of the most popular ESG frameworks. Details for each framework follow the infographic.

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

Details on the most popular ESG frameworks below:

In 2022, the International Sustainability Standards Board (ISSB) newly formed as a global initiative to define better standards for sustainability and ESG disclosure. It’s a sister body to the International Accounting Standards Board (IASB.) The ISSB standards aim to build upon the following frameworks:

ISSB recommends that companies “continue using their voluntary frameworks and guidance as appropriate.” Using frameworks from the list above will likely aid an easier transition when the new standards are available.

(Formerly “Carbon Disclosure Project”)

Note: CDP is helping inform global climate standards as part of the new ISSB (International Sustainability Standards Board).

Note: On Jan 31, 2022, CDSB was consolidated into the new ISSB (International Sustainability Standards Board).

In 2021, IIRC and SASB merged to become the Value Reporting Foundation (VRF). In June 2022, VRF merged into IFRS (International Financial Reporting Standards) as part of the new ISSB (International Sustainability Standards Board). ISSB plans to build upon the “Integrated Reporting Framework” when defining its global standards for sustainability disclosure reporting.

In 2021, SASB and IIRC merged to become the Value Reporting Foundation (VRF). In June 2022, VRF merged into IFRS (International Financial Reporting Standards) as part of the new ISSB (International Sustainability Standards Board). ISSB plans to build upon SASB standards when defining its global standards for industry-specific sustainability disclosures.

Note: *The UK is considering adopting TCFD recommendations in its legislation. The US's SEC Climate Disclosure rule is based on TCFD. This framework is also informing climate disclosure standards for the ISSB (International Sustainability Standards Board).

Note: WEF is helping to inform metrics for the new ISSB (International Sustainability Standards Board).

Companies must take time to consider their options before deciding which framework is the best fit. There are a few key steps to take during this process:

Selecting the right framework for building your ESG program and reports can be a challenge. Armanino is experienced with numerous, diverse frameworks. Contact our ESG consultants today to help determine the best ESG frameworks for your business.

From risk assessments and framework selection to report guidance and independent assurance of data, our team can assist your ESG strategy and efforts.