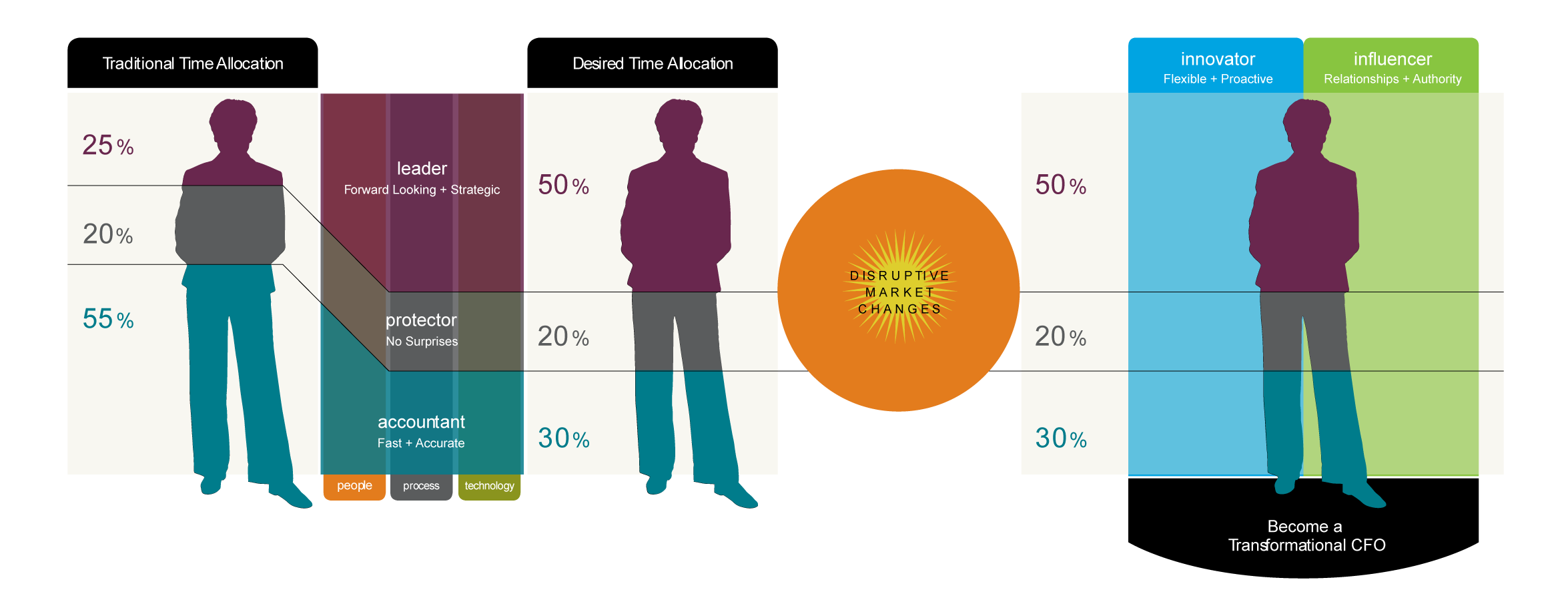

In today’s world, which is defined by volatility, uncertainty, complexity and ambiguity, organizations need their CFOs and other C-level leaders to play a broader, more strategic role — and CFOs know it. But how do they free up time and shift their focus from traditional reporting and compliance to forward-looking, strategic leadership?

Finance leaders often look immediately to new systems and technology to increase operating efficiency, but that’s not enough. While such tools play a significant role (more on that later), technology is just one lever in a broader program of enablement. A transformative approach to leadership requires having the right people in place and fostering a culture of commitment and creativity, as well as optimizing processes through innovation and technology.

Innovation is critical to success in today’s market, and it begins with attracting and retaining the brightest minds. If you only hire people with industry experience, you may miss out on opportunities for different perspectives that can lead to breakout growth. Instead, focus on a potential hire’s motivation, passion, creativity, and willingness and aptitude for learning. While these nontraditional hires will potentially require additional industry-specific or technical training, the benefits of access to a much broader talent pool can create dramatic results for your business.

The majority of new hires are millennials, so business leaders also must adapt to this group’s style and mindset. In many ways, the millennial approach better meets the demands of the 21st century business landscape. This generation is driven by solutions rather than tasks, and by out-of-the-box thinking. A preference for technology solutions, expectations of transparency, and a refusal to take no for an answer are all millennial traits that support the kind of transformational change seen in many of today’s most successful brands. Embracing and adopting the millennial mindset can help your business attract talent and thrive in the modern marketplace.

Hiring the right people is a good start; keeping them happy and positioning them to succeed is just as critical. You need to build trust by spending more time with the team in the trenches (where you can also spot ways to improve processes). But transformative leadership goes beyond trust to encompass the very nature of the employer-employee relationship. Millennials want to be treated as partners in success rather than employees who simply follow orders. If they sense that they are perceived as just another number on a page, they won’t hesitate to turn to a different page.

Allowing team members to be part of the strategic growth of the company — up to and including sharing in its profits — can maximize individual contribution and employee retention for team members of every generation. But day-to-day productivity and overall job satisfaction are influenced by many factors, and not just in the obvious areas. Extending a flexible approach to issues like telecommuting, or even control over office temperature, can improve retention and productivity, often more than you might expect.

Growth brings complexity. To sustain growth, you need processes and technology that will accommodate that additional complexity. But many businesses today rely heavily on a collection of different “best-of-breed” software solutions that are not integrated out of the box.

As a result, CFOs (and all C-level leaders) must analyze disparate information generated by multiple systems to assess trends, find answers and identify opportunities to improve margins. In the traditional role of accountant, visibility into the company’s costs and performance exists only in the rearview mirror — a look back and an educated guess forward.

Advanced technology solutions can unify these disparate systems and consolidate information to allow real-time visibility and automated tracking and reporting. What were once time-intensive manual processes can now be automated so they require far fewer staff hours, and finance leaders can access high-quality data and predictive analytics to inform business decisions and catalyze growth.

But it’s important to note that these benefits are only possible when the solution fits the need. Here are some key points to consider when evaluating technology to find the best fit:

By optimizing your processes and technology, and aligning your people and culture, you can transition into a more strategic role and spearhead the transformational change that drives sustainable growth in today’s dynamic marketplace. To learn more how we can help you become more strategic, contact our CFO Advisory team.