In 2014, the IRS increased its scrutiny of stock option pricing and began an audit program for 409A deferred compensation plans. The tax implications of incorrect pricing can be extensive, so this increased oversight makes a strong, supportable valuation process more critical than ever for privately held high-tech and life sciences companies.

Your board needs to understand the valuation process before they approve grants of stock options. To help you walk them through stock option pricing, we’ve detailed the process for valuing stock options after a Series A preferred stock financing (at arm’s length with sophisticated investors). For privately held companies, this type of financing provides one of the best indicators of a company’s market value.h

Why Valuation Matters

Unsound stock option pricing methodology can have major tax consequences for your company and your workforce. If the IRS determines that you’ve violated IRC Section 409A and priced your options below their fair market value, your employees will be liable immediately for taxes on the value of their stock options, plus a 20% penalty. Your company will owe payroll tax on the options and, more significantly, will probably have to placate angry employees by paying their option-related taxes and penalties.

When You Need a Valuation

Per IRS rules, you need to do a 409A valuation as close to the stock option grant date as possible, and you must update the valuation at least once a year. Significant events―such as a round of financing― or changes in control, even if foreseeable, also require a new valuation.

How to Use the Option Pricing Method

The Option Pricing Method (OPM) defined in the current American Institute of Certified Public Accountants (AICPA) valuation guide, Valuation of Privately-Held-Company Equity Securities Issued as Compensation, is a common method of allocating equity value between preferred stock and common stock, and is widely used for 409A valuations.

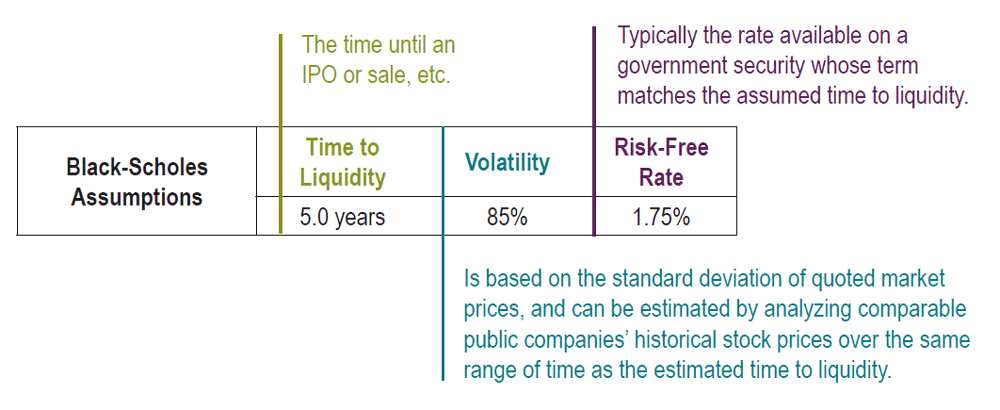

The OPM makes assumptions based on the Black-Scholes model, including the time to a liquidity event, volatility and risk-free rate. Within the OPM framework, the “backsolve” method uses the price of a recent preferred stock financing, along with its liquidation rights and any special conditions, to work backwards and solve for the total equity value of the company.

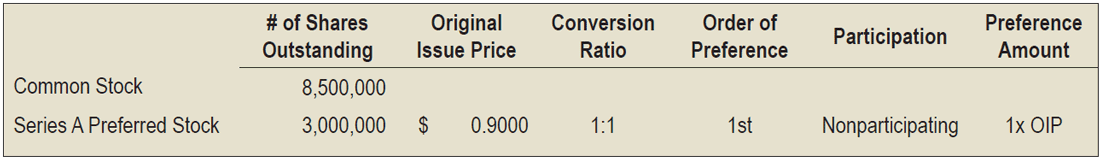

Below is a capitalization table for a company that recently closed a $2.7 million Series A preferred stock financing.

The Black-Scholes assumptions are:

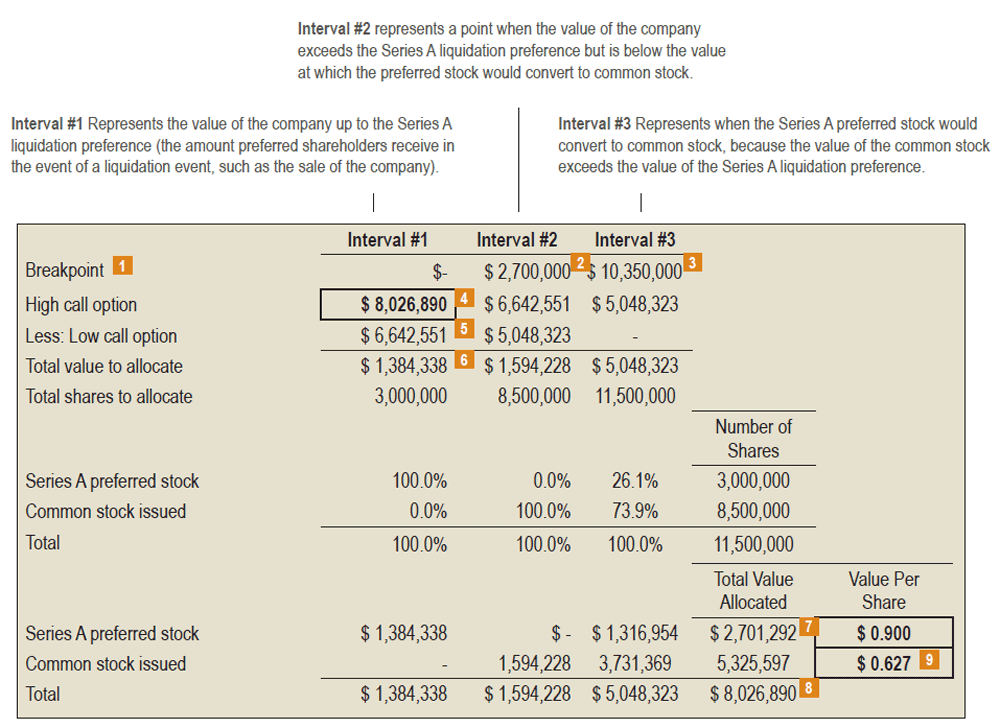

Based on this information, you can use the backsolve method to determine the total equity value of the company. In the example:

A breakpoint 1 is an equity value at which the recipient of the proceeds changes. The $2.7 million breakpoint 2 is the total liquidation preference of the Series A preferred stock, which gets the first $2.7 million. After this breakpoint, the common stock receives money, until the next breakpoint of $10.35 million 3 is reached. At the equity value of $10.35 million, the Series A stock receives more money if it converts to common stock, so above the $10.35 million breakpoint, both common and Series A stock are allocated money.

In Interval #1, the initial high call option is the total value of a 100% equity interest in the company ($8.027 million) 4. The low call option of $6.643 million 5 is the price that a buyer would be willing to pay for all proceeds above the first breakpoint of $2.7 million. That is, according to the Black-Scholes formula, the option to acquire all sales proceeds in the company above $2.7 million has a value of $6.643 million (hence the name Option Pricing Method). Note that the low call option for Interval #1 becomes the high call option for Interval #2.

For each interval, the dollar amount allocated to the class(es) of stock is calculated by subtracting the low call option from the high call option. In Interval #1, the difference is $1.384 million 6, which is allocated to the Series A stock. The Series A will also receive part of Interval #3, and the total amount allocated to the Series A stock is $2.701 million 7 . It is important to understand that the Series A is allocated an amount that is approximately equal to the total investment amount in the Series A financing ($2.7 million), because this amount is what we are basing this backsolve valuation on.

The 100% equity value of the company is $8,026,890 8 and the common stock is valued at $0.627 per share 9.

Depending on the complexity of a company’s capital structure or the underlying asset valued, other pricing methods, such as the binomial lattice model and the Monte Carlo simulation method, may be appropriate. These methods are frequently applied to complex derivative securities that have embedded features, such as down-round protection or performance provisions. These derivative instruments can trigger special accounting treatment as a liability required to be stated at fair value on FASB GAAP- compliant financial statements.

Incorrectly priced stock options can mean serious tax consequences for a company and its employees―especially now that the IRS is focusing on the issue. A strong, supportable valuation process is more critical than ever, and your board needs to review this process thoroughly before they approve grants of stock options. Use this guide to help them understand why valuations matter, when they are needed and how the valuation process works.

December 19, 2014