Sales are the key driver of any business, and your lead-to-cash solution is a vital catalyst of your sales success. Yet, many organizations have lead-to-cash processes that are muddled and manual, with different teams working out of different systems, poor visibility into revenue forecasting, and missed opportunities to get a holistic view of pricing, discount and contract data. Many also struggle to go beyond the lead-to-cash cycle to leverage key data to further serve customers and thus continue the cycle.

If you’ve noticed that your lead-to-cash process is disjointed and that your finance, marketing and sales teams are disconnected, it may be time to re-engineer your lead-to-cash process.

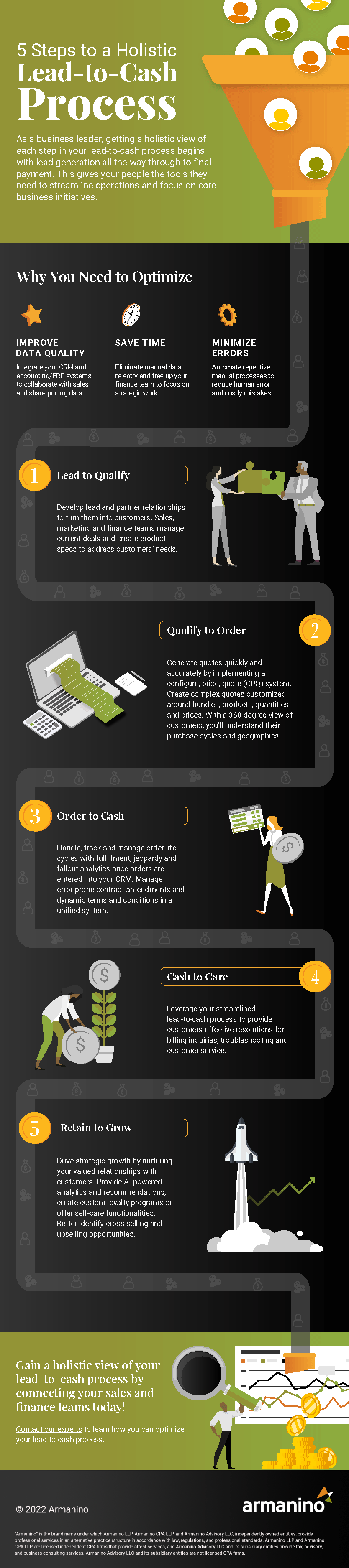

The lead-to-cash process refers to the end-to-end life cycle of selling to and servicing customers, starting from marketing and lead generation and progressing step-by-step through final payment. At a high level, this process flow encompasses order management, billing and payment, and sales fulfillment.

The traditional lead-to-cash process is mission-critical — but is also extremely manual and error-prone. If your company is working with a customer relationship management (CRM) system that isn’t integrated with other systems or doesn’t support the unique requirements of your organization or industry, this may add up to overly manual processes and a lot of room for error. Sales and finance team members may feel overburdened by the manual steps they must take to sell your products and record revenue. And if your lead-to-cash process is spread out across multiple systems (or even worse, spreadsheets), then your sales, marketing and finance teams may also be working with blind spots — and without a single source of truth.

A strong lead-to-cash process can maximize efficiency and boost profitability. By streamlining your lead-to-cash process and unifying your data in a single system, you can reap the following benefits:

Working with a unified CRM and enterprise resource planning (ERP) or financial management system allows you to collaborate more effectively with sales and pricing data in one place. By merging all data into one platform, all sales opportunities stay up to date and no crucial updates go overlooked. Integrated systems allow you to use 360-degree views of your customers to better target them in your marketing campaigns. Additionally, business leaders can see profits and losses in real-time and make informed decisions daily as circumstances change, instead of receiving a paper report after it’s already too late.

Integrating your data within a single system alleviates the burden of tedious, manual data re-entry from your finance staff and frees them up to focus on high-value strategic work, preventing avoidable mistakes and increasing productivity. It also allows you to more quickly meet customer needs and reduces the time wasted searching through multiple files and systems for critical data.

With a streamlined lead-to-cash process, you can maximize your return on investment and minimize costly mistakes. Aligning your ERP and CRM allows you to do more with fewer resources, and automating manual processes reduces the chance of human error.

Before you begin restructuring your lead to cash process, it’s critical to evaluate each phase of the process, assess how your organization manages each step and identify opportunities for improvement.

The lead-to-cash process can be broken into three primary phases: lead to qualify, qualify to order and order to cash.

The lead-to-qualify stage covers relationship development and management with leads and partners, with the goal of converting them to customers. In this phase, sales, marketing and finance teams must be able to seamlessly manage deals in progress and develop product specifications and methodologies to manage their customers’ specific needs.

The qualify-to-order stage focuses on direct sales. Implementing a configure, price, quote (CPQ) software is a critical factor of this step. With a CPQ software, you can create complex quotes with different customizations around bundles and products, quantities and prices and customer-facing documents and terms.

With the whole CPQ process in one system, sales reps can generate quotes quickly and accurately. For example, by using an integrated Salesforce CPQ solution within the Salesforce platform, sales reps can have a 360-degree view of customers, including their purchase cycles and geographies.

This stage begins when customers decide to proceed with an order, and the order is entered and registered within your CRM system. This stage includes handling, tracking and managing the order life cycle with fulfillment, jeopardy and fallout analytics. Once the sale has been completed, you may still be grappling with contract amendments and dynamic terms and conditions. If these critical data points are being managed across different spreadsheets and systems, you increase your risk of human error — and potentially even lost revenue, billings and collections.

Continuing to take care of your customer after the payment is finalized and the contract is closed is a great way for your organization to differentiate itself from competitors. As such, there are two additional closeout stages that are crucial to supplement successful lead-to-cash processes: cash to care and retain to grow.

Implementing a cash-to-care phase ensures that you aren’t abandoning your client immediately after order transactions are complete. This stage represents the opportunity you have to assist with billing inquiries, troubleshooting and customer service. Customer and workforce management are core objectives here — using a streamlined lead-to-cash process, you can use your in-depth view of every customer to provide efficient and accurate resolutions.

The retain-to-grow phase focuses on the steps you can take to retain your customers and drive strategic growth. As part of this stage, you can continue to champion your customers’ success and nurture your valued relationship with them. This may include providing your customers with actionable AI-powered analytics and recommendations, creating personalized loyalty programs and promotions or introducing self-care functionalities that make it easy for your client to support themselves without constant need for intervention by a care agent or sales rep. You can also look at opportunities for cross-selling and upselling.

Improved data quality with integrated customer and finance systems allows your team visibility into key insights about your customer base. Understanding the full cycle of where your customers come from, how they engage with you and why they choose to work with you is essential to your operational success. You can use that information to better understand how else you can support their needs. It’s even possible to see connections and solutions they may not have considered – and thus, haven’t asked for either. Deepening your understanding of your customers and providing them proactive solutions transforms you from just another vendor into a vital trusted partner. And a trusted partnership ignites growth – both for you and for your customers.

As a finance leader, getting a holistic view of each step in your lead-to-cash process begins with lead generation through to final payment. This gives your people the tools they need to streamline operations and focus on core business initiatives.

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

The prospect of re-engineering your lead-to-cash process may seem overwhelming but assessing your current processes and taking steps to improve it today will help ensure future success.

Take the first step in overhauling your lead-to-cash process by:

Before you know it, you will boost profitability and efficiency, enhance your customer experience and benefit your bottom line.

Armanino specializes in helping organizations achieve a complete lead-to-cash automation by identifying the right process flow and tools to help you accomplish this.

Our lead-to-cash experts can help you assess, plan and execute process re-engineering to ensure you minimize errors and maximize profits. Contact our business application software consultants through the from below if you'd like to learn more about optimizing your journey and explore our integration solutions.

Reach out to our team to build your lead-to-cash process flow so you can optimize sales efforts, enhance customer experience and drive revenue growth.