Our annual survey reveals the latest trends in how software-as-a-service (SaaS) companies are capitalizing sales commissions and software development costs, including the impact of regulatory changes and a proposed model for initial development cost capitalization.

Sales commissions and software development costs (including website or application development costs) remain among the top expenditures for SaaS companies. Chief financial officers, chief accounting officers and other SaaS finance and accounting executives need to continually evaluate and monitor the industry for emerging trends pertaining to the accounting of these costs.

Our 2024 SaaS survey provides a valuable tool to gauge how your organization compares to its peers in these key areas. It includes 100 of the top publicly traded SaaS companies (ranked primarily by market capitalization). We collected the survey information from participants’ Form 10-Ks, reflecting data for the most recent fiscal year ending prior to June 1, 2024. In addition to looking at capitalization over time, we also examined capitalization by revenue and auditor.

Table of ContentsFor reference, here are the rules specific to development cost and commission capitalization.

ASC 340-40, issued in conjunction with ASC 606 and adopted by most companies in 2018, mandates that companies capitalize sales commissions if such costs are expected to be recovered through future revenues unless the amortization period is one year or less.

The capitalization of costs incremental to obtaining a contract and determining the amortization period is one of the most significant areas affected by the revenue guidance, as companies no longer have the option to immediately “expense as you go.”

SaaS development costs are subject to “internal use” software capitalization rules, which typically have a longer development window for eligible costs to be capitalized, versus the “external use” rules for software licensing companies. The tables below summarize the applicable Financial Accounting Standards Board (FASB) rules.

| SaaS: Which Rule to Apply to Your Development Costs | ||

|---|---|---|

Internal Use Software |

SUBTOPIC 350-40 | Cost capitalization begins when the preliminary project stage is finished, management has committed to funding the project and it is probable that the project will be completed and the software will perform the function intended. Capitalization ceases when the project is substantially complete and is ready for its intended purpose. |

Website Development Costs |

SUBTOPIC 350-50 | Capitalize costs incurred to purchase software tools or costs incurred during the application development stage for internally developed tools. |

| Traditional Software License | ||

|---|---|---|

Costs of Software to Be Sold, Leased or Marketed |

SUBTOPIC 985-20 | Capitalization begins when technological feasibility has been established and ends when the product is available for general release. |

In December 2017, the Tax Cuts and Jobs Act (TCJA) amended IRC Section 174 to require R&D expenditures to be capitalized and amortized over a period of five to 15 years for amounts paid beginning in tax year 2022. Internal software development costs were specifically noted and must be capitalized and amortized. Year one (2022) created a significant tax impact because only half-year amortization is allowed.

As a result, many SaaS companies now may have substantial taxable income. We’ve seen some companies face three to four times the previous year’s tax liability as these regulatory changes have put them in a taxable position for the first time. Companies may assume they have tax attribute carryforwards to offset the income (e.g., net operating losses and tax credits), but these are often limited or not available under IRC Section 382 and the amended Section 174.

Minimize your tax impactStakeholders, the C-suite and especially the treasury and tax functions of SaaS companies must adopt a strategic approach to minimize the financial impact of the rules . Working with your tax advisor to plan and maximize efficiency is critical for your bottom line.

Consider these actions:

In October 2024, the FASB issued a proposed Accounting Standards Update to revise the guidance on accounting for internal use software. The amendments in this proposed update would apply to all entities subject to (1) the internal use software guidance in Subtopic 350-40 and (2) website development costs guidance in Subtopic 350-50, but would not affect “external use software” entities subject to Subtopic 985-20. These updates are already best practice, and this proposal will not have a significant impact, but issue a clarification for the initial development cost model.

The amendments in the proposed update would remove all references to a prescriptive and sequential software development method (referred to as “project stages”) throughout Subtopic 350-40. The proposed amendments would specify that a company would be required to start capitalizing software costs when both of the following occur:

In evaluating the probable-to-complete recognition threshold, a company may have to consider whether there is significant uncertainty associated with the development activities of the software. The proposed amendments also would require a company to separately present cash paid for capitalized internal use software costs as investing cash outflows in the statement of cash flows.

What to watch forThe comment period has closed, and now the FASB board will deliberate and issue a final Accounting Standards Update as part of its annual release process.

Issues to look for include:

Armanino consultant Andrew Hyde, a former CFO for SaaS companies such as Salesforce, OptionEase and Solid Instance, shared these thoughts on the FASB proposal:

"FASB decided to move forward with two amendments that appear to have been derived from consideration of the single model approach. While potentially helpful, we still believe that software development costs should be capitalized consistently, whether for internal or external applications. There is enough managerial judgment involved in the decisions surrounding expense versus capitalization that, for practical purposes, we believe that management could likely justify a similar result under either ASC 350-40 or ASC 985-20. The effort to continue different accounting approaches can be confusing to accounting teams, tax professionals and software development teams who may be working on both internal and external applications.

In either case, under present standards, FASB recognizes the creation of an asset having long-lived value to the enterprise. This approach reflects what is already occurring as software companies align with SaaS companies’ practices, moving away from the “technical feasibility" standard. The FASB would be well served to adopt the single model approach to recognize a natural evolution taking place in the market."

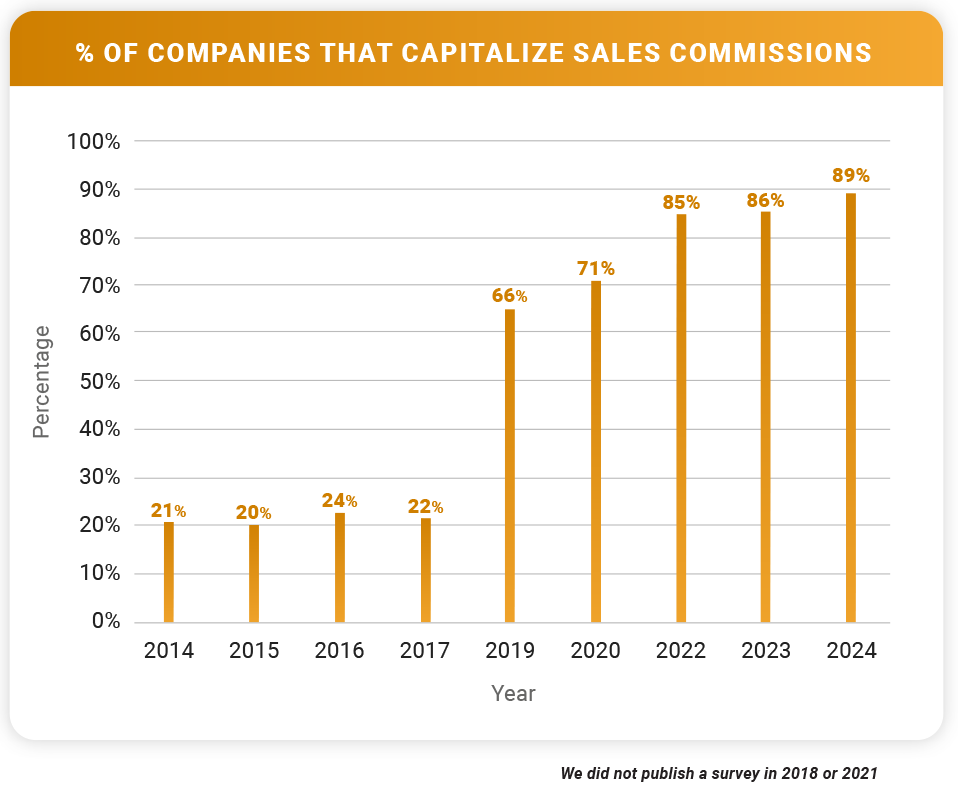

ASC 606 dramatically changed the revenue recognition landscape in 2018, effectively mandating that companies capitalize commissions, if material. As a result, the capitalization rate in the 2019 survey (66%) tripled compared to the 2017 survey (22%). In 2024, registrants capitalizing commissions remained high at 89%, increasing 3% from 2023. This may represent a leveling off of sales commission capitalization.

In 2024, companies that did not disclose commissions capitalized (either claimed commissions were immaterial or were related to deals of less than one year) represented 11% of companies surveyed, down from 34% in 2019. This number is virtually unchanged versus last year, which is to be expected, given that most SaaS companies pay significant commissions and sales teams typically focus on multi-year deals.

Not surprisingly, the SEC has issued comment letters to certain registrants concerning how they account for costs incurred to obtain contracts. Examples of such comments (adapted) are as follows:

“Please tell us and revise to disclose whether commissions are earned on cloud subscription renewals. If so, disclose whether they are commensurate with the commissions earned on the initial contract and how you account for such commissions. Refer to ASC 340-40-35-1 and 340-40-50.”

“Tell us how you considered the amounts paid for business development efforts, advisory services and the salaries and wage expenses, in determining that these were not allocable to costs of service revenues. Please provide us with your accounting policy governing the recognition of costs of service revenues and explain how the policy criteria were applied in evaluating such costs. Please also clarify how you view the excluded amounts relative to the guidance in FASB ASC 330-10-30-1 and 30-8, and FASB ASC 340-40-25-2 and 25-7, in determining that such costs would not be capitalizable as contract costs, if this is your view.”

“Registrant discloses that it pays sales commissions based on contract value upon signing a new arrangement with a customer and upon renewals. Registrant further discloses that it amortizes deferred sales commissions over the expected customer life, which is approximately five years. Please tell us, and revise to clarify, whether commissions paid upon renewal are commensurate with initial commissions. Also disclose how commissions paid for renewals are considered in your five-year period of benefit for the initial commission. Finally, disclose the period of time over which you amortize commission costs related to contract renewals. Refer to ASC 340-40-35-1 and 340-40-50-2(b).”

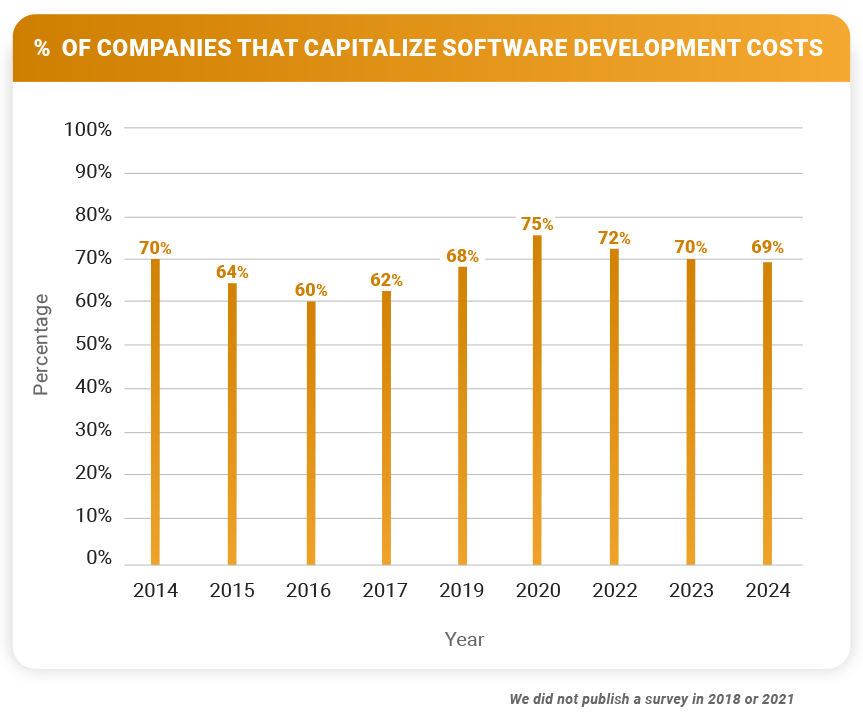

The percentage of companies capitalizing software development costs decreased just 1% between 2023 and 2024, perhaps indicating a leveling out of the number of companies seeking to capitalize these costs.

It’s interesting to note that despite the apparent diversity in practice (some companies appear to capitalize software development costs while similar peers do not), our search of the SEC EDGAR database for SEC comment letters on this topic over the past two years revealed none, suggesting that the SEC is not currently focused on this disparity.

Note: Under the current rules, training an artificial intelligence (AI) model to develop software is not considered a capitalizable expense. At the same time, AI is being widely used to accelerate software development, resulting in shorter development cycles. These compressed timelines are also reducing the useful life of software. This combination of fewer eligible costs and a diminished useful life is likely driving the decline in capitalizing software development costs.

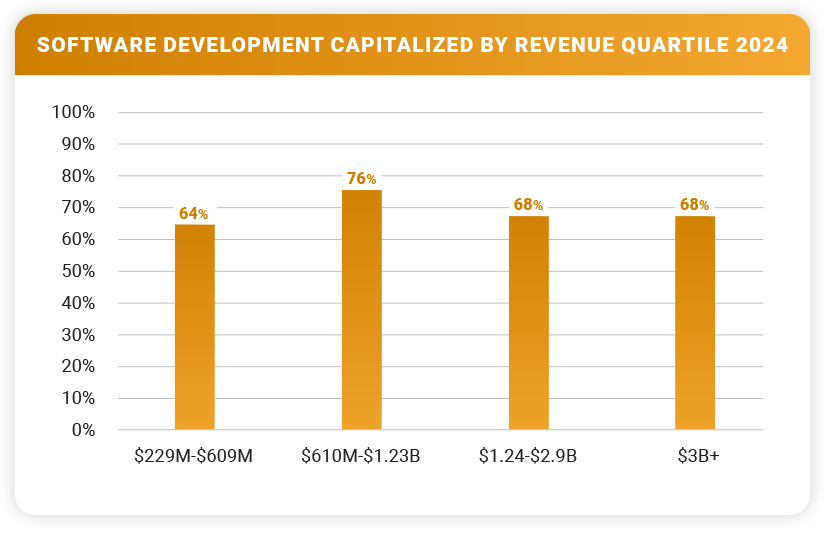

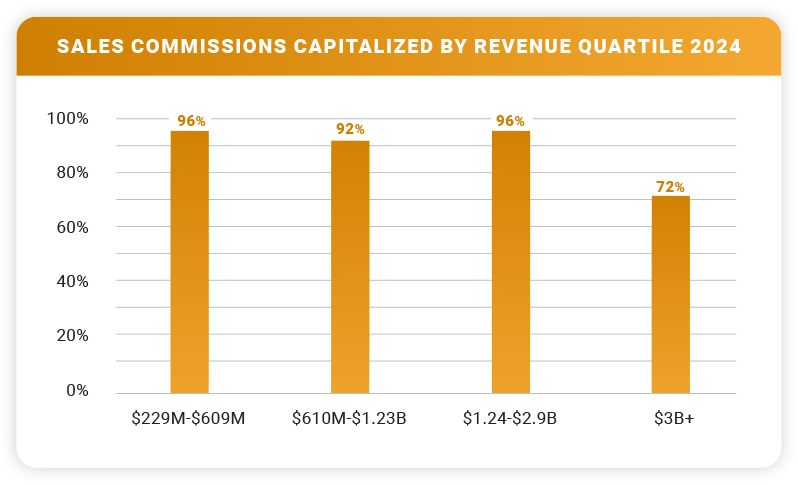

In this year’s survey, we also sorted the firms by revenue into four brackets, with 25 firms in each bracket: $229 million to $609 million, $610 million to $1.23 billion, $1.24 billion to $2.9 billion and over $3.0 billion.

In 2020, the data showed that companies with higher revenue tended to capitalize software development costs more often than companies with relatively lower revenue. Today, the percentage of companies capitalizing development costs is relatively consistent, regardless of company size.

In 2023, companies with relatively lower revenue tended to capitalize sales commission costs more often than companies with higher revenue. The same is true for 2024. Roughly 72% of companies in the $3.0 billion and over bracket capitalized commission costs, while over 90% of companies in the three lower brackets capitalized commission costs.

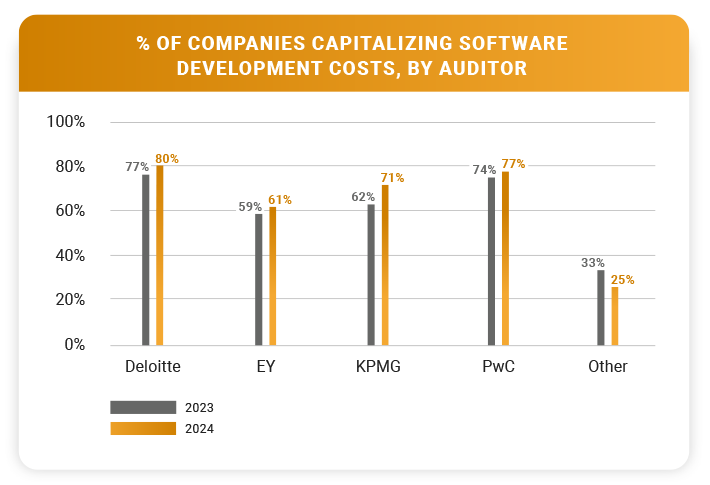

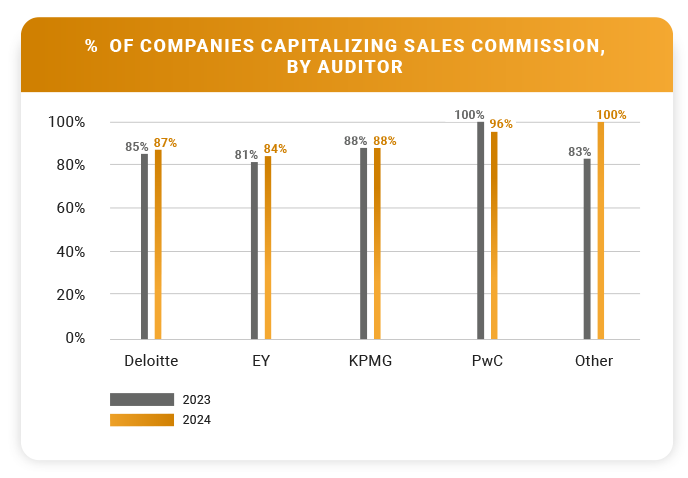

We also analyzed capitalization practices based on the companies’ independent registered public accounting firms (auditors). The data showed a disparity in practices based on the audit firm.

Of the 100 companies surveyed, 96 used Big Four auditors. The graphs below show the capitalization practices of companies for each Big Four auditor and for the four companies that did not use a Big Four audit firm.

Among the registrants audited by the Big Four, 80% of Deloitte’s clients capitalized software development costs in 2024, while EY had the lowest percentage at 61%. Notably, the percentage of “other auditor” clients capitalizing software development costs decreased from 33% in 2023 to 25% in 2024.

Among the registrants audited by the Big Four, PwC had the highest percentage of clients (96%) that capitalized commissions in 2024, while EY had the lowest percentage at 84%. There was relatively little movement in rates of capitalization from 2023 to 2024. Among registrants audited by other firms (not Big Four), there was an increase from 83% capitalizing commissions in 2023 to 100 % in 2024.

In light of the survey findings and the ASC 606 standard, SaaS companies should continuously evaluate their decisions on capitalizing software development and commission costs, as there are several short- and long-term implications. They should also consult with their auditors and, ultimately, adopt the method they believe most closely aligns with the intent of the rules.

Finally, SaaS companies should keep a close eye on the FASB annual release because the proposal may significantly alter the rules related to capitalization of development costs.

Download the full research report below to view the top 100 SaaS companies surveyed in 2024 and footnotes from the companies’ 10-Ks.

Download prior years’ surveys: