Updated February 10, 2025

Sage Intacct is a modern cloud accounting software platform that gives you a clear, real-time view of your finances in one place. This enterprise resource planning (ERP) solution is ideal for small to midsized businesses. It simplifies core accounting functions like accounts payable, accounts receivable, cash management and general ledger management with real-time reporting and dashboards to make day-to-day operations more efficient.

The software helps reduce administrative headaches by centralizing your financial data, so users don’t have to dig through spreadsheets or re-enter information across multiple systems. For example, you can automatically consolidate financials across multiple entities, saving time and reducing manual errors.

Sage Intacct is geared for small to midsized organizations that are growing and need user-friendly, agile finance tools. It’s designed to evolve with your business. While it’s a standout choice for industries like healthcare, nonprofits, family offices, SaaS, manufacturing, construction and real estate, it can be an excellent solution for any organization that is multi-entity, multi-currency and/or has outgrown basic accounting software like QuickBooks.

It’s hard to know if your business is functioning according to plan when your financial data is everywhere except where you need it, especially if you’re managing multiple locations and entities. Here’s why finance leaders choose this cloud-based ERP:

While Sage Intacct is a popular choice, other options exist. For example, NetSuite offers a comprehensive suite of features for larger businesses. Microsoft Dynamics 365 provides extensive customization capabilities. And QuickBooks offers a user-friendly experience that’s ideal for small businesses. It’s important to compare options against your organization’s current and future needs to select the solution that makes the most sense for long-term success.

As a finance leader, your team faces persistent challenges that hinder productivity and growth. Whether it’s accomplishing more with fewer resources, eliminating manual errors, keeping up with compliance demands or enabling your finance team to shift focus to value-added work, Sage Intacct can help you overcome these daily obstacles:

Sage Intacct offers specialized solutions and modules for various industries. Here’s a breakdown of the key benefits, features and considerations for Sage Intacct industry-specific modules for construction, distribution and manufacturing, real estate and nonprofit.

Ideal if you need:

Sage Intacct operates entirely in the cloud. This has several advantages compared to traditional, on-premises accounting systems:

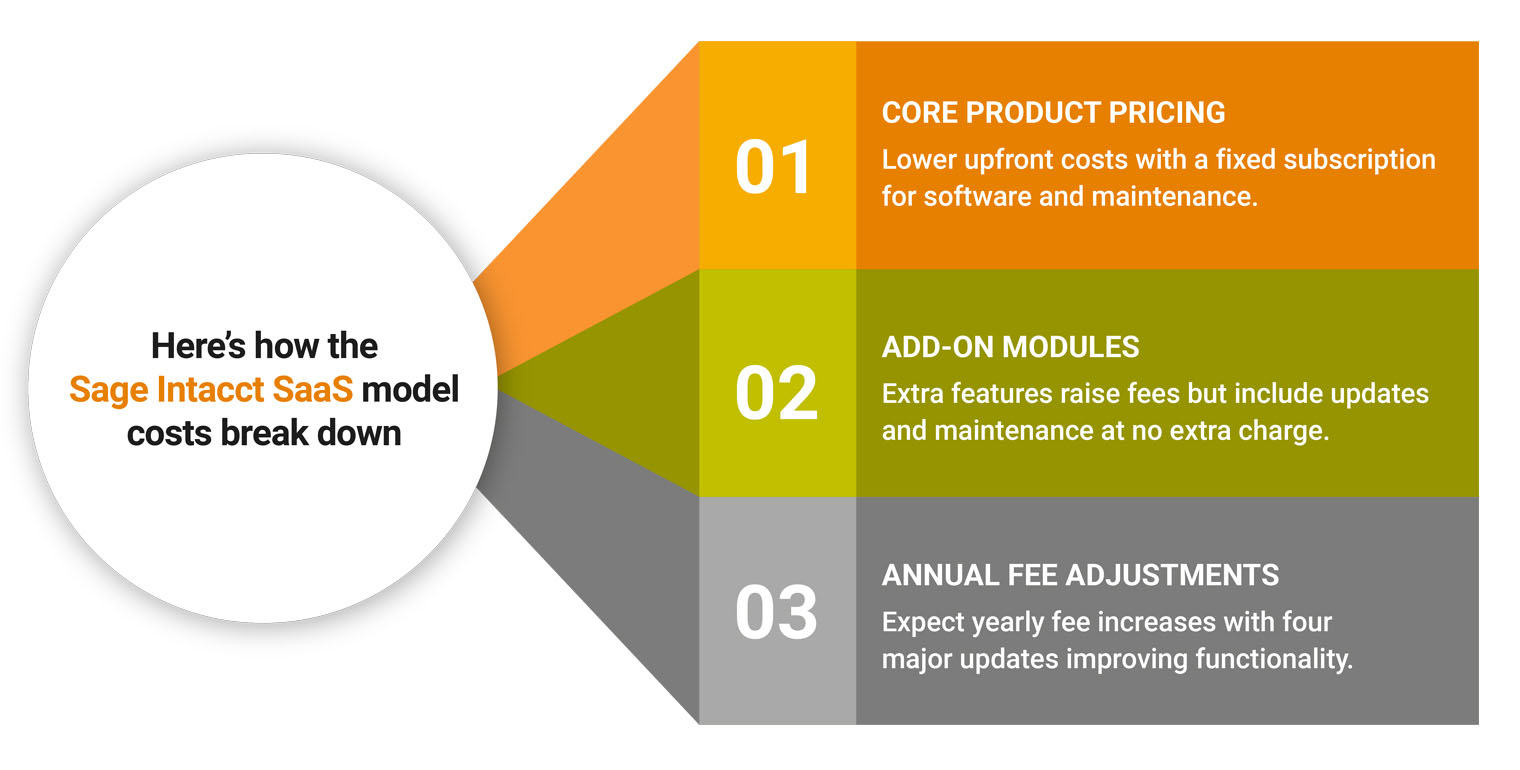

Sage Intacct’s software-as-a-service (SaaS) subscription model differs greatly from the traditional on-premises perpetual license models.

With on-premises ERPs, you usually pay a substantial upfront cost, including licensing, hardware and infrastructure costs. Perpetual licensing models don’t typically include the ongoing support costs for your ERP, so you’ll need to consider that in your side-by-side cost comparison.

Here’s how the Sage Intacct SaaS model costs break down

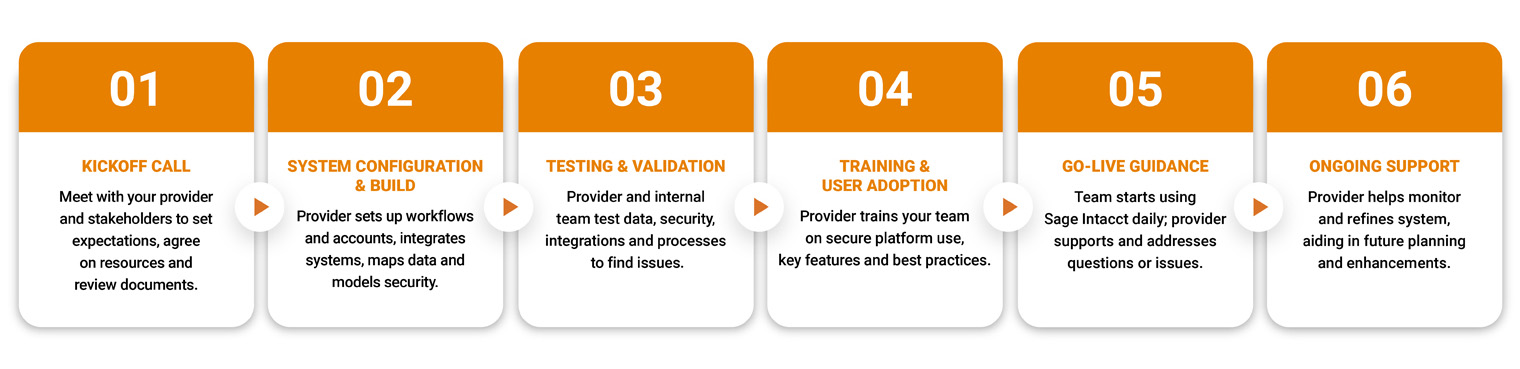

Transitioning to Sage Intacct involves a structured, step-by-step approach to minimize business disruption and ensure a smooth migration. From start to finish, the process usually spans about 12 weeks, followed by six weeks of post-deployment support. Here’s what to expect:

Attend a joint kickoff call with your Sage Intacct provider and internal stakeholders to set expectations, agree on resourcing strategies, establish timelines and review necessary documents. This ensures that everyone involved is aligned and ready to proceed.

Your Sage Intacct provider will configure the system to match your specific business processes and requirements, including setting up workflows, accounts and integration with other systems (like payroll or CRM). This process also includes data migration mapping and security modeling, actively refining the system to meet your needs. Since it’s a cloud solution, there’s no need for onsite servers or maintenance, but your provider will work with you to integrate any systems that need to communicate with Sage Intacct.

Once the system is configured, testing begins. During this stage, your internal team will work alongside your provider to test your Sage Intacct setup and make sure everything functions as expected. This includes testing the accuracy of migrated data, security testing, making sure all integrations work and confirming that day-to-day processes run smoothly. It’s a collaborative effort to validate configurations, identify potential issues and ensure smooth operation.

After testing is complete, your Sage Intacct provider will conduct detailed, hands-on training sessions with your team, covering how to use the platform, navigate key features and apply best practices. Since Sage Intacct is accessed entirely via the cloud, your team will learn how to log in and work securely from any location. This step equips them to use the system effectively, helping them become comfortable with it before going live.

During the go-live phase, your team begins using Sage Intacct for daily tasks. Your provider will closely support them and address any questions or issues that arise as you transition to the new system.

After the system is live, your Sage Intacct provider will focus on continued monitoring and system refinement. Experts will continue to optimize performance based on real-world usage and feedback. Your provider will also assist with future phase planning and system enhancements to ensure Sage Intacct continues to evolve with your organization.

Evaluate your current workflows and identify a transition timeframe that minimizes disruption. Some considerations for the least disruptive timing include end of fiscal year versus during a quieter period for the organization seasonally, budgeting cycles and timing relative to other IT upgrades.

But you need to prioritize your transition. While waiting for a quieter period or specific milestone in your operations can make sense, waiting for the “perfect moment” can hold your organization back. Consider the impact of waiting: prolonged inefficiencies, diminished productivity and increased frustration across your team. The reality is that the perfect time may never come, and each month you delay could mean enduring another server outage, another failed backup or yet another late Friday in the office manually pulling data into spreadsheets.

Tip: A Sage implementation provider with an outsourcing function can offer extra support with daily accounting tasks and additional staff resources while you’re in the middle of your transition to the cloud. This helps ensure that core finance work isn’t pushed to the wayside, and your team gets up and running smoothly.

An effective Sage Intacct implementation requires careful planning and execution. But it goes beyond just following a step-by-step approach; it’s about prioritizing collaboration, being receptive to change and ensuring everyone is on the same page. Based on our experience implementing Sage Intacct for thousands of clients, these best practices make the transition smoother and faster:

Choosing the right implementation firm is just as important as selecting the right software. As a premier Sage Intacct partner for over 10 years, we’ve helped more than 2,500 small and midsized companies implement the software to unlock the benefits of total financial visibility and simplified workflows. Learn more about what contributes to the success of your ERP project and explore how our award-winning Sage Intacct experts can help you address your unique challenges and get the most ROI from your Sage implementation.

Unlock the benefits of total visibility and streamlined workflows. Contact our Sage Intacct experts today to learn how to start driving innovation for your organization.