Updated June 09, 2023

One key characteristic of a successful business today is how its leadership leverages technology. The strongest organizations have taken advantage of high-performing tech stacks to become nimbler, more efficient and more responsive to their customers’ ever-changing needs.

Despite all the solutions that are available, many business leaders struggle to implement the technology needed to remain competitive. It’s common for an organization’s legacy systems to be a barrier to transformation since they are often inefficient, silo-constrained and unable to provide data for decision-making.

This means, for example, that accounting and financial planning and analysis (FP&A) teams are often buried by the rekeying of data, manual reconciliations, uneven workloads, and copying and pasting data and formulas for reporting — a direct obstacle both to getting the time to deliver on more strategic value to the business and to retaining top talent. Sales and marketing professionals are often constrained on how they can personalize their interactions with customers and how they can deliver insights to the rest of the business on customer trends.

The transformation of your organization will remain little more than a pipe dream if you don’t evolve your tech stack to cut manual processes and provide visibility for your finance, sales, marketing and other teams. And any technology upgrade requires a plan, from the issues to address and the applications to address them, to where to start and where you’re headed.

This is especially essential now that cloud technology has lowered the bar to deploying and maintaining applications, enabling teams across departments to do it themselves. Without a plan, you risk creating chaos with lack of integration and more silos, building the next generation of your technology hairball.

Creating a coordinated plan across all of the solutions needed by a business used to be almost impossible. Long deployments, painful upgrades and virtually no connectivity between apps made piecemeal deployment the norm.

But no longer. Thanks to the efficiency with which cloud-based enterprise resource planning (ERP), customer relationship management (CRM) and other business systems are now deployed, the wide availability of packaged integrations, and the ease of use that enables business owners to make changes, business leaders are now equipped to architect and evolve to an integrated tech stack. This shift in turn provides the analytics and automation that are essential for helping your organization stay relevant and competitive.

Today’s typical business technology landscape has evolved organically, rather than by design. In many organizations, the rapid change in technology over the past few years has led to a diverse array of legacy apps, ad hoc cloud deployments and a significant number of stubborn spreadsheet processes, among other challenges.

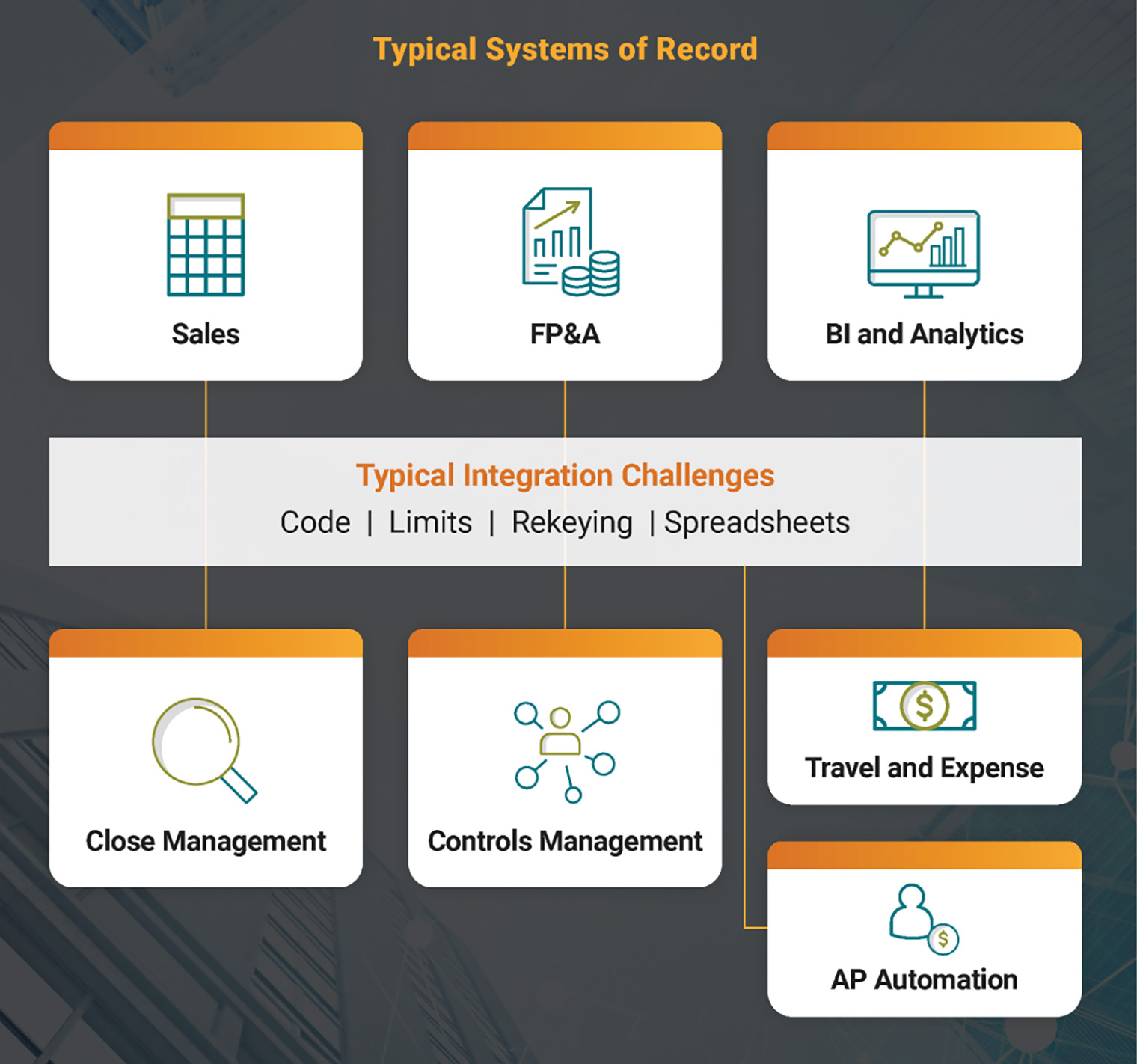

Whether you’re using older, on-premise systems or newer cloud apps, many manual integration points remain. Employee-facing processes such as purchasing or travel and expense management vary from spreadsheets to hard copies to HR-centric proprietary web apps and cloud apps.

Apps usually don’t connect with each other and rely on proprietary integrations or spreadsheet-based “solutions” that are either error-prone or have limited usefulness. Whether processing incoming sales orders, reconciling transactions between the accounting system and bank/credit card systems, or performing three-way matches across POs, invoices and receipts, systems integration is often lacking.

Budgeting and planning often consists of sending spreadsheets to line-of business managers, and frequently requires the FP&A team to perform most of the manual entry themselves. This usually means budgets and forecasts quickly become stale and outdated.

In many cases, monthly management and financial reports, or performing analysis, still requires repetitive data extracts from the accounting system into spreadsheets, adjusting formulas and formatting each time, and refreshing pivot tables.

And in accounting, managing the financial close and controls often still means performing thousands of reconciliations, manually entering journals, hunting for account balance variances in spreadsheets, and relying on close and controls checklists based on spreadsheet files, word processing documents and gut instinct.

Legacy systems are often a direct obstacle to teams delivering more strategic value to your business and to attracting and retaining top talent.

Last but not least, when it comes to talent, a legacy tech stack can make it difficult to get the right people onboard. Filling key roles can be a hurdle since a legacy system often doesn’t make it possible for you to hire remote workers. A legacy system can also discourage new talent from joining your organization since it offers no opportunity for employees to grow their skills on the latest technology platforms. Plus, that physical system will need hands on-site to maintain it. Considering the difficulty of finding qualified candidates, hiring to fill roles for security, data centers and licensing updates, and managing third-party relationships can be tough.

A well-planned technology stack that takes advantage of the current wave of cloud-based solutions can deliver significant near- and medium-term benefits:

Integration of ERP and CRM systems can provide various benefits to an organization. By enabling departments to share data efficiently, it leads to better decision-making and improved analytics and reporting. Integration also helps in eliminating redundant data entry tasks, increasing efficiency and productivity while streamlining business processes. Furthermore, it allows organizations to provide a better customer experience, with real-time data access that helps customer service representatives respond quickly and resolve issues more effectively, resulting in improved customer satisfaction and loyalty. Packaged integrations between well-established apps provide solutions for standard business processes, with cloud apps playing well with existing on-premise and legacy investments.

These are the four critical ingredients for a robust departmental tech stack:

While there is no one-size-fits-all tech stack, the key is to make sure that each of your technology investments is best-of-breed, and that your vendors are continually innovating and improving integration with one another.

It’s not uncommon to outgrow solutions, but each app should sustainably support growth in your head count, transactional volumes and complexity for the foreseeable future.

Laissez-faire is never a strategy. Whether designing blueprints forw a house or establishing a vision for business technology, it’s alwaysw better to have a defined team to build a strategy and execute on it.

The team should:

It’s impossible to build a coordinated technology plan without a roadmap. To create your roadmap, you need to document all of your business requirements for each area, measure your potential solutions against those requirements, and determine which are better to handle your needs. Once you’ve arrived at your short list of solutions for each area, map together business processes between them to understand what data is going to be flowing from which system to which.

Want to break down silos and avoid fortifying internal fiefdoms? Keep in mind any technology decisions that departments like sales and services are making that may intersect with finance business processes. Build a partnership and plan together.

You also need to consider the sequence in which you’ll implement your solutions. Your roadmap should ensure that each step of the plan builds on the one before, and that prior investments aren’t wasted with subsequent upgrades.

While some organizations decide to start with the financial close to free up resources, for example, others may need to fix their ERP foundation before moving on to other components of the stack. The right implementation partner can help you assess your situation and map your sequence based on the impact in your environment, the impact to your team, etc.

In general, the financial close and FP&A processes both can be addressed regardless of the ERP, and they are mutually complementary. They are the least disruptive upgrades, typically replacing spreadsheets, and both deliver relatively fast time to value. Usually, there’s no need to rip and replace old technology. Many apps provide connectors that integrate with legacy and newer ERPs, AP apps and CRMs.

As you evolve your technology stack, there will be unforeseen hiccups due to data migration, unanticipated requirements or an unexpected integration gap. Choosing best-of-breed providers for both your CRM and ERP helps reduce the risk because these providers typically have well-rounded capabilities and have seen most types of integration.

Today’s finance, sales and marketing teams must be more efficient and agile, and become strategic leaders for their businesses. This requires the right technology and a coordinated technology plan.

Cloud applications can address your needs for virtually every sales, marketing, accounting and finance business process, including core CRM, ERP, FP&A, account reconciliations and close management. By implementing best-of-breed applications, and by integrating and sequencing the upgrades to ensure all the parts fit together and add value to each other, you can build an efficient technology stack that provides the analytics and automation that are essential for the success of your organization. Contact our business application consulting team to discuss the future of your tech stack.