The Securities and Exchange Commission (SEC) requires U.S. public companies to file quarterly and annual reports, which discloses their financial and business activities:

The phrase SEC reporting can put fear into the hearts and minds of executives at public companies and soon-to-be-public companies, and for good reasons. The reporting process is complex, with ever-changing regulations and high stakes when it comes to accuracy and compliance.

There’s plenty for you, as a financial leader, to know and to keep up with. This article serves as a comprehensive guide on the SEC reporting process — what steps and information are required, the challenges and practical solutions.

Going public means a high level of scrutiny from the SEC. Public companies must file reports covering their financial performance, strategic directions and operational information, including challenges such as talent shortages and various other internal control weaknesses.

The reports have multiple functions and benefits, not just for the SEC, but for a variety of audiences. Yes, the reports will help your company stay compliant. They can also help maintain your company’s market integrity, protect your investors by providing company information to make informed financial decisions and give regulators and the public insight into your company’s performance and sustainability.

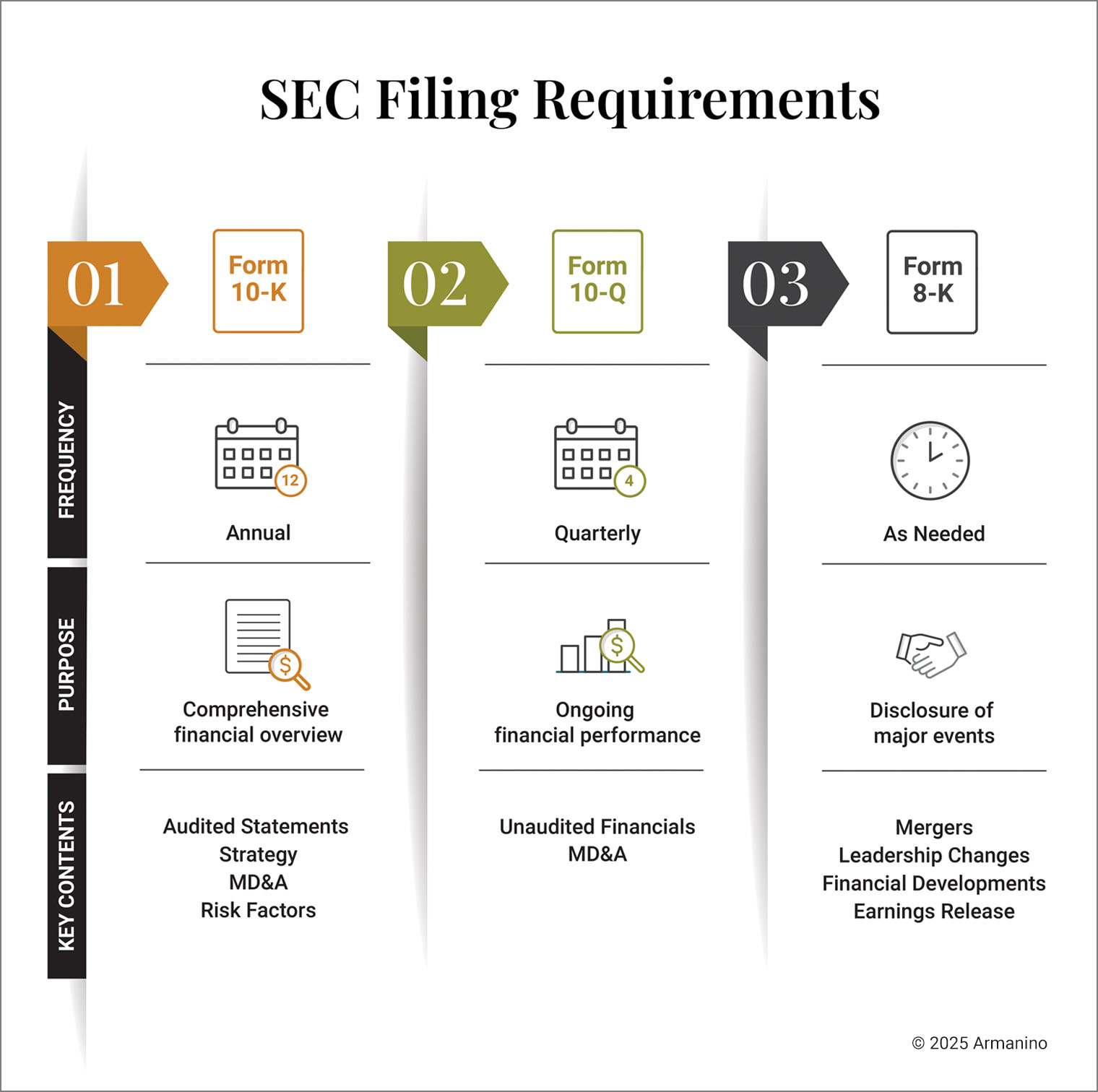

U.S. companies are required to file three main reports:

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

What a company discloses in a report can vary depending on the business and industry; however, there is a common process or a series of steps, a disclosure checklist, to follow for filing reports. Deadlines depend on the type of report and filer. For example, for a 10-K, a “large, accelerated filer” (a large public company with a market value of $700 million or more that has been reporting for at least one year and has produced one 10-K) must file within 60 days. A non-accelerated filer (a public company with a market value of less than $75 million) has up to 90 days to file a 10-K.

The first step for filers is identifying which of the three main forms are required at that time: annual, quarterly or major financial event reporting. This step also includes being current on what’s needed as these requirements change.

The SEC regularly sends out notifications of new or modified regulations. For example, a requirement taking effect generally in 2024 focuses on segment reporting. In other words, how do you slice and dice your business? By geography? U.S. operations versus European operations? By product? If you miss this fairly new disclosure, you could be out of compliance. So, it’s important to stay up to date.

Next comes gathering and verifying financial information. Some companies underestimate what’s involved. It can be a complex process, requiring input from multiple sources such as legal, finance and regulatory groups within the company. It can also be time-consuming, especially if the infrastructure is not optimized for the process and has siloed systems.

The usual third step is drafting the reports with software such as ActiveDisclosure from Donnelley Financial Solutions. The DFIN platform connects documents, data and people to better manage compliance, audit, financial and performance reporting. Internal finance and legal teams then review the report for accuracy and completeness. If required, the financial information is certified at this time. External auditors can also be brought in for a review, which is more common for Form 10-K.

The final report is then submitted on the EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system to meet the deadline.

When you think about what could keep your company from filing on time, the list of obstacles is long and complex:

Audits of U.S.-listed public companies are overseen by the Public Company Accounting Oversight Board (PCAOB). Navigating the PCAOB landscape has become tougher with its auditors stricter about what they expect in terms of reporting.

The consequences of missing SEC reporting deadlines go beyond that quarter’s bottom line. A company could face restatements, penalties from the SEC, a damaged reputation, a loss of investor confidence and more.

Some of the consequences may include the following:

Read This Next: SEC Reporting Shortage: Is Your Tech Company at Risk Consequences of Missed Deadlines

Outsourcing provides a solution where the outside resource is heavily relied on during the reporting process. The client company provides information as requested. A variation is co-sourcing, which is sharing the management between internal and external resources.

With the right provider, accounting outsourcing can meet the challenges of SEC reporting and help your company stay compliant. The provider can offer a team who understands and is always up to date on the ever-changing SEC requirements, with expertise and services in compliance and financial areas and advanced technology to ensure no gaps in coverage and reporting.

Where does your public company or soon-to-be public company stand on SEC reporting? Are you up on the ever-changing requirements? Do you have the internal expertise and time for handling all the details to deliver on deadline? We do, so you can relax. Find out how our SEC Compliance Consultants can help you stay compliant with a solution designed for your business.

Tired of operational roadblocks? Get a free, 30-minute, private consultation with outsourcing experts to roadmap your back-office optimization.