Maintaining a positive cash flow is critical for any business. Particularly in today’s volatile economic climate, your stakeholders want to see clear-cut, unequivocal proof that your organization is earning money and can be successful in the long term.

However, as a SaaS business leader, you know that’s not always possible. Because a SaaS business model requires a sizeable upfront investment, it can take months or years before your company turns a profit, leaving your organization with substantially negative cash flows, skittish stakeholders and a daunting path forward.

You may have the confidence to look beyond sustained negative cash flows and toward the return of hockey stick growth projections. But to keep your SaaS company afloat, you need to be able to explain this journey from sustained losses to positive cash flows to your investors, board members and other stakeholders – and ultimately improve your cash flow for the long haul.

Here are some key metrics you need to understand to tell your story, and some steps you can take to achieve better cash flow.

SaaS companies need to grow at a fast enough rate quarter over quarter to reach their bookings targets, which has a cumulative negative effect on cash flow. While this may sound backwards, it must be underscored that in SaaS, one of the primary financial challenges is overcoming the upfront cost of growth, incurred long before profits on new customers eventually exceed the cost to acquire them. This dynamic produces a cash trough: a period of significant growth in which cumulative cash flows are negative.

To better manage (and explain) your cash trough, you need to understand the metrics that drive customer value and the unit economics of growing your business.

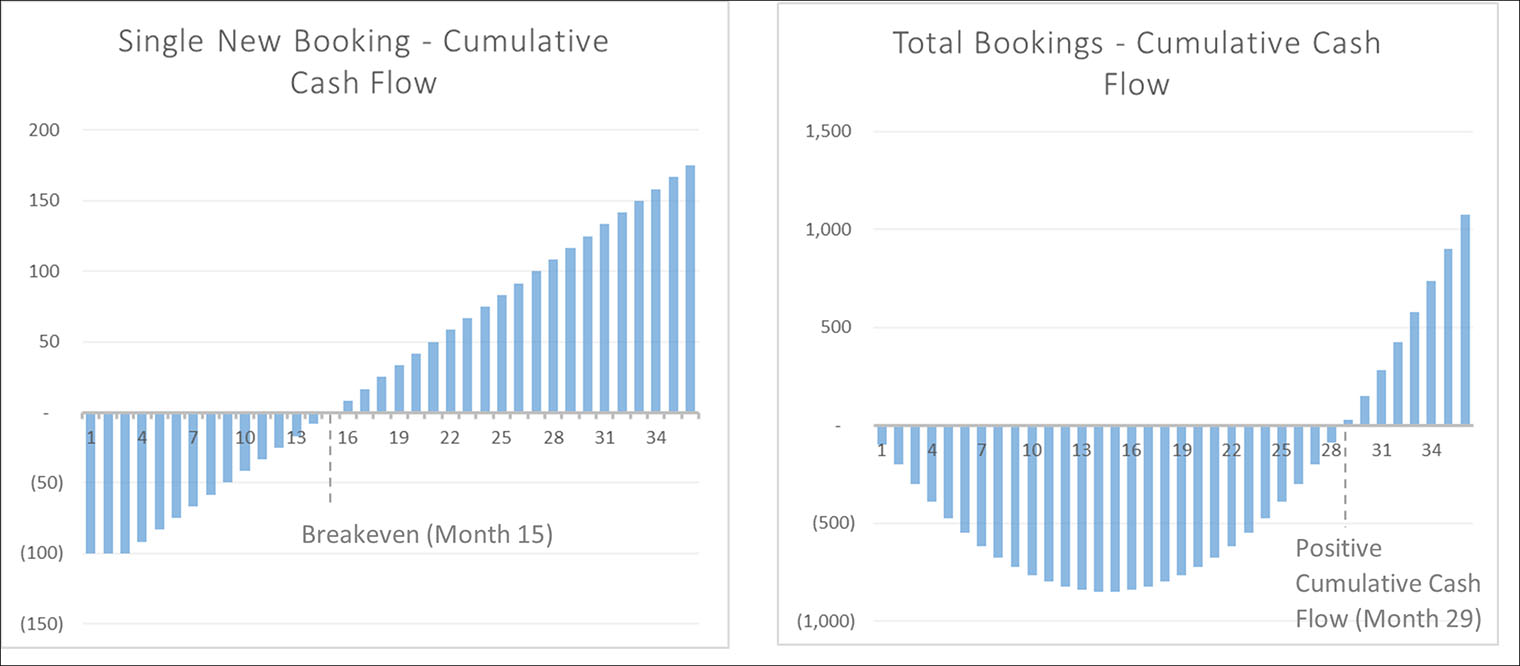

We have modeled out two views to illustrate how growth impacts cash over time:

Assumptions:

Single New Booking: In the above example, we spend $100 in the first month to acquire new business. This new business eventually signs in month four, reflecting a three-month lag between our initial spend and first cash inflow from that investment. Then, we gradually recover profits against our CAC by recognizing months of MRR at $8.33, finally breaking even in month 15.

Total Bookings: Extrapolating this effect on cash flows with continuous CAC spend and new bookings every month yields the cash trough we see between months 1 and 28 in the second graph. Our cash trough, which might seem alarming to unfamiliar eyes, is all part of the plan. We eventually turn the corner and rocket into positive profits starting in month 29.

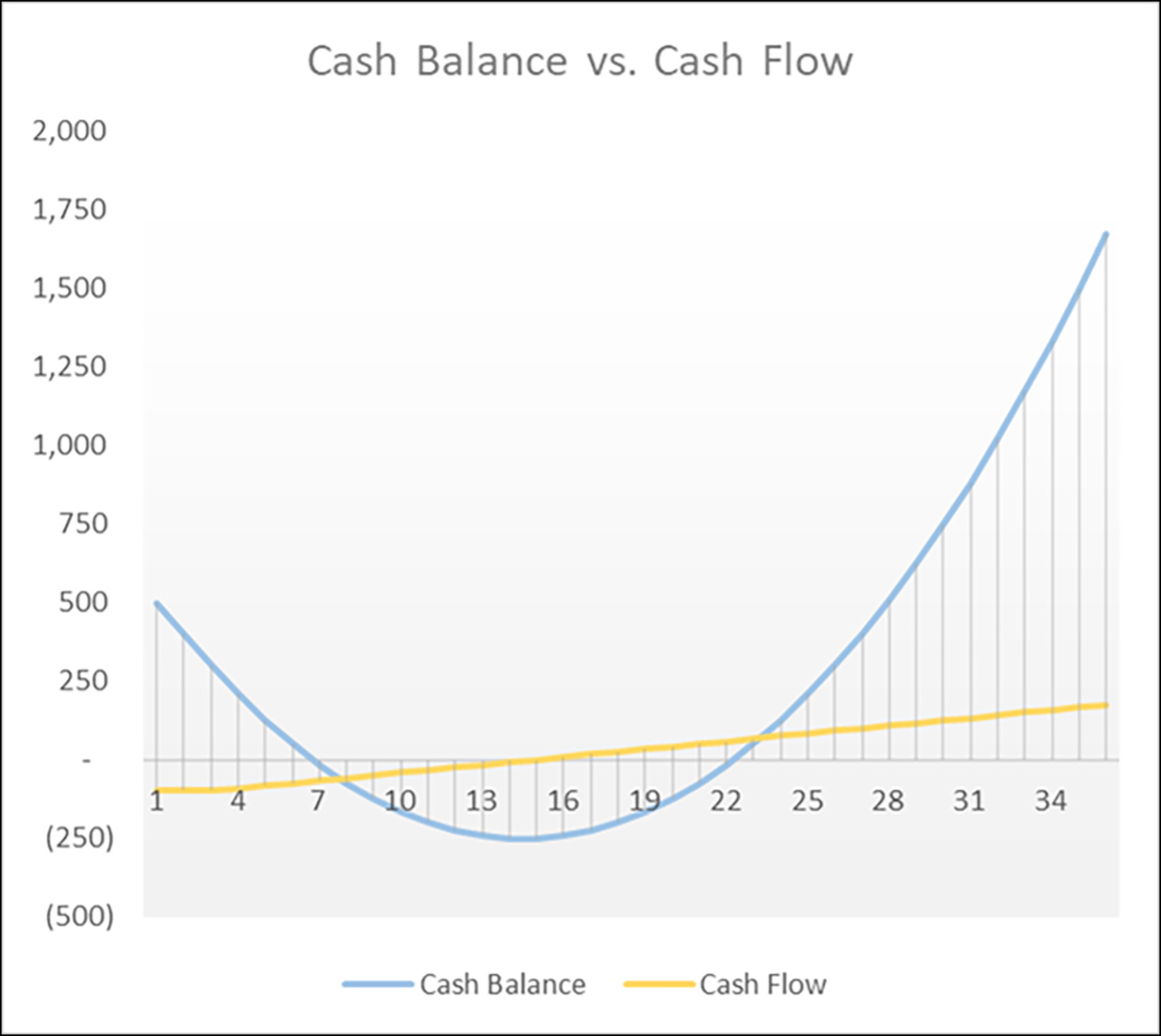

Continuing with this growth plan, consider its effect on our cash balance, starting with a balance of $500.

Based on this graph showing our cash flow and cash balance over time, we see that our starting balance of $500 is not enough on its own to sustain the cash squeeze of our projected growth. With this information, we can identify our cash runway, which tells us how long we can survive before we must secure funding (in this scenario, approximately six months). It also tells us the minimum amount of cash we need to raise to avoid a negative balance.

In this case, we know we need to raise at least $250 to sustain our growth. That said, targeting a balance of $0 is a risky proposition, so some cushion should be applied to the final fundraising value.

Note: This simple model only considers CAC as our cost element. In reality, we would want to consider all operating expenses including general and administrative (G&A) and research and development (R&D) costs, which would drive the trough deeper.

By sharing this story with your investors, board members or other stakeholders, you can help ease their concerns regarding these seemingly challenging cash projections — especially in times of significant growth.

In addition to understanding your cash trough, it’s also important to identify steps that can be taken to improve your cash flow, potentially reducing your fundraising amount or eliminating the need to fundraise altogether.

By billing customers in advance in less frequent chunks, you can drastically improve cash flow. For example, shifting from monthly billings to semi-annual upfront billings at the same revenue rate yields six times as much cash in hand as of the first month of service (i.e., collecting on six months of revenue upfront vs. one month of revenue upfront). Shifting to annual billings increases this delta twofold. However, this comes with a catch: customers may not have the appetite to pay significantly more in advance (weakening their own cash flows) without some discount or other concession. So, it is best practice to model several scenarios that consider various discounts when assessing alternative billing schedules. Some common schedules include quarterly, semi-annual or annual billings.

Additionally, the extent to which you decide to discount for upfront billings should be determined within the context of your cost of capital. For example, if your cost of capital is 25%, then a discount on annual upfront payments up to but not exceeding 25% would be acceptable. If the customer discount were to exceed the cost of capital, then your organization would essentially be giving away more value in discounts than it would cost to fundraise to cover the cash squeeze.

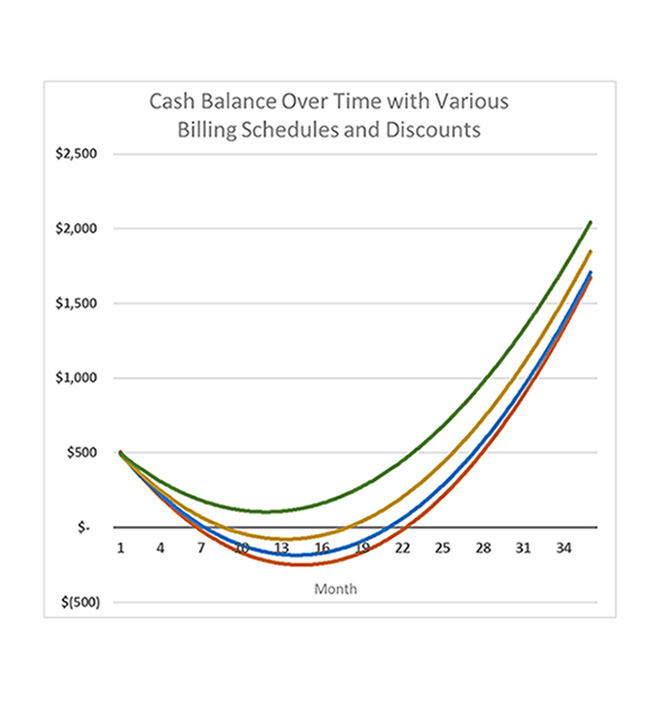

The below model illustrates the impact on cash balance of various billing schedules, with increasing discounts as we extend to larger, less frequent cash collections.

Assumptions:

CAC = $100 spent monthly

Three-month lag between CAC and new booking

Starting cash balance = $500

No expansion or churn

MRR and Discount by Billing Schedule:

● Monthly Billings MRR: $8.33

● Quarterly Billings MRR: $7.92 (5% off)

● Semi-Annual Billings MRR: $7.50 (10% off)

● Annual Billings MRR: $6.67 (20% off)

The red line at the bottom of the graph reflects the same cash balance projection we illustrated in the prior figure, where we needed to raise $250 to sustain our growth projections. This represents our cash balance in a monthly billing schedule.

As we move up from monthly billings to quarterly billings with a 5% discount, semi-annual with a 10% discount, and annual with a 20% discount, we see great relief on our cash squeeze despite increasingly large discounts.

In the quarterly billing scenario with a 5% discount, we only need to raise $188, a reduction of 25% compared to our fundraising target in the monthly billing scenario. In the semi-annual billing scenario with a 10% discount, we only need to raise $90. That’s 52% fewer dollars needed than in the monthly billing scenario. Finally, in the annual billing scenario with a 20% discount, we don’t need to raise any funds at all.

Completing this modeling exercise could help you potentially reduce fundraising needs and, ultimately, save a great deal of equity.

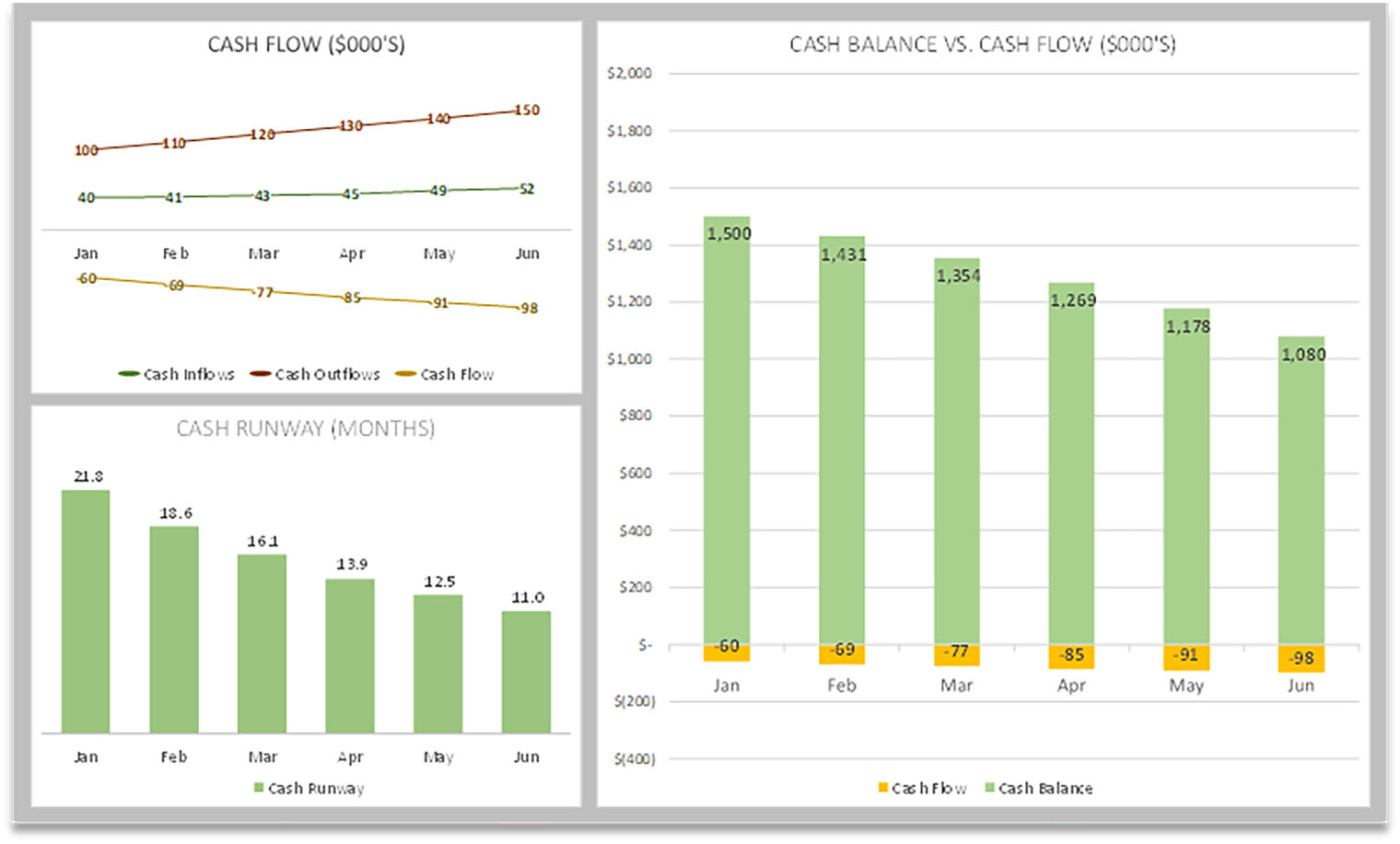

Maintaining a cash dashboard is another tool you can use to help improve your cash flow. By dashboarding your major cash metrics, you gain instant visibility into how they trend over time, allowing you to pinpoint problem areas that may need further analysis.

Useful items to track on a monthly basis include cash flow (inflows vs. outflows), cash runway (months) and cash balance vs. cash flow.

In a SaaS organization, the path to a positive cash flow is not as clear-cut as it may be for traditional businesses. But that doesn’t mean it’s impossible. Ensuring that your investors, board members and stakeholders understand the nuances that come with SaaS cash flow allows you to keep those resources in your corner while you take the steps to improve and stabilize your cash flow – ultimately setting your business up for long-term profitability.

To learn more about how to ensure your SaaS company has the right processes, tools and resources for success, contact our experts.