Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

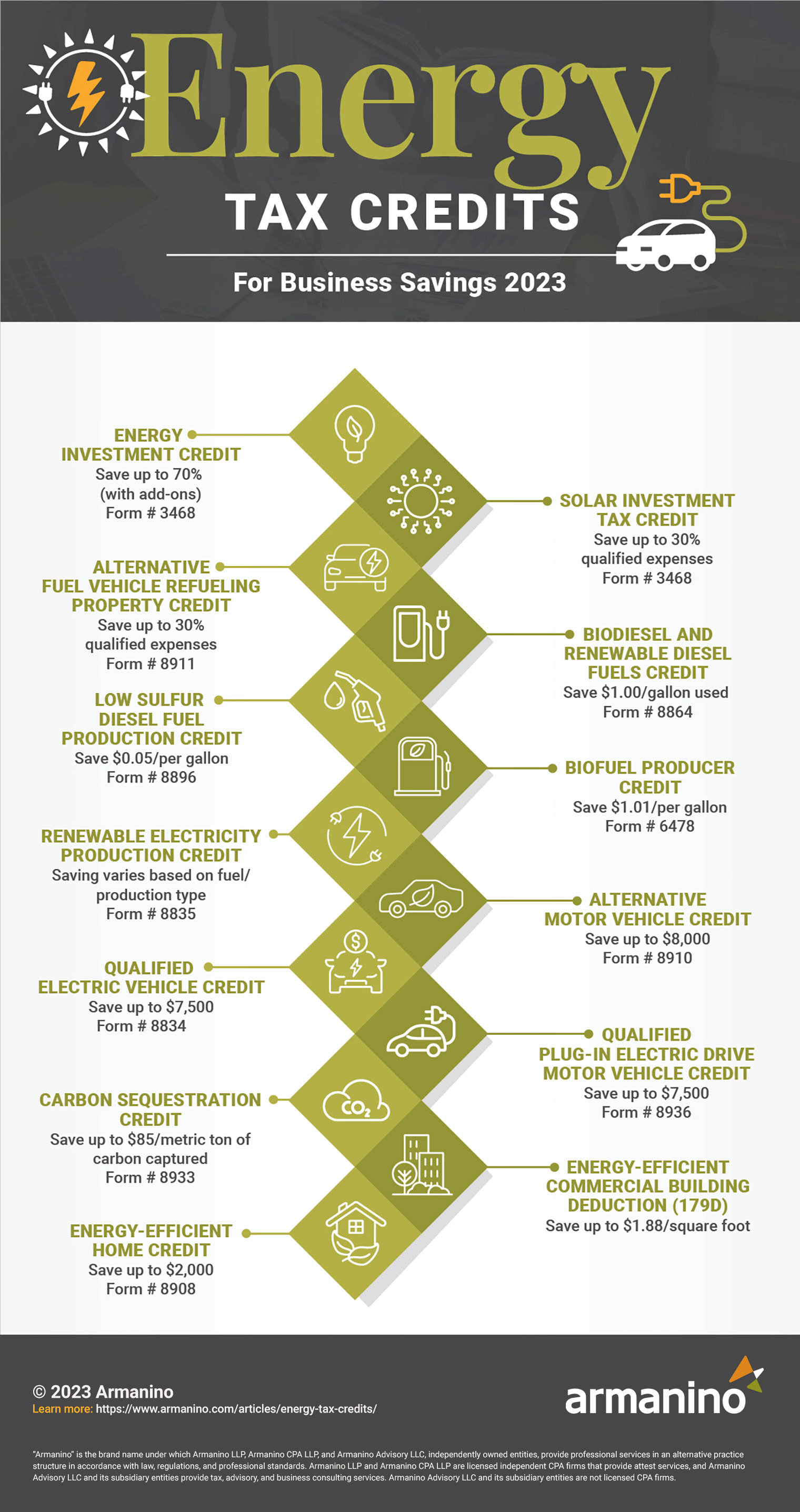

This credit (also known as the "Rehabilitation, Energy & Reforestation Investment Credit," "Energy Credit" and "Energy Investment Tax Credit (ITC)") saves up to 70% (with add-ons) of the total purchase and installation costs of certain renewable energy properties. This includes credits for rehabilitation, energy, qualifying advanced coal projects, qualifying gasification projects and qualifying advanced energy projects.

Type: Nonrefundable

Dates: Applicable for property placed in service after January 1, 2023

Claim Process: File Form 3468, Investment Credit with

annual federal income tax returns.

This federal credit, a subset of the Investment Tax Credit (ITC), is applicable for new (or considered new) energy property used by a business and saves up to 30% of costs for new solar energy systems where a business or individual owns (not leases) and uses the system in the United States.

The ITC savings percentage scales down as follows:

Type: Nonrefundable

Dates: Solar properties where construction began after December 31, 2019, and before January 1,

2023.

Claim Process: File Form 3468, Investment Credit with

annual federal income tax returns in the year the solar system was placed in service.

The IRS qualifies construction as “started” when 5% of project costs have been incurred. Solar-powered units that illuminate, heat/cool water or generate electricity along with their respective storage equipment, installation and labor costs are eligible. (Solar systems for heating swimming pools or hot tubs are not eligible.) See the U.S.Department of Energy Residential and Commercial ITC Factsheets for eligibility and savings specifics and exceptions.

Several U.S. states and territories additionally offer solar tax incentives or rebates. California, Minnesota, Texas, New York, Colorado and Oregon offer over 100 solar incentives. Visit the Database of State Incentives for Renewables & Efficiency (DSIRE) for program details. If you’re considering solar lighting or solar panels, be sure to leverage both federal and state tax incentives.

Note: The Solar Tax Credit (IRS Form 3468, ITC) applies for businesses while the Residential Solar Energy Credit (IRS Form 5695) applies for individual homeowners. The rules are similar, but differ slightly.

This credit saves up to 30%, capped at $30,000, of the total cost of renewable energy equipment purchased and is available to those who install and store sources of renewable energy during the current tax year. It includes the costs of installation of charging stations for electric vehicles.

Type: Refundable only after offset against Section 4041 quarterly fuel excise tax liability

Dates: Applicable for refueling property placed in service before 2021.

Claims Process: File Form 8911, Alternative Fuel Vehicle

Refueling Property Credit with your federal income tax return.

This credit saves $1.00 per gallon and is available to businesses and individuals who use biodiesel, agri-biodiesel or renewable diesel in their vehicles or as the on-road fuel for their business or trade.

Type: Nonrefundable

Dates: Fuel sold or used between 2018 and 2022.

Claims Process: File Form 8864, Biodiesel and Renewable Diesel

Fuels with annual federal income tax return.

This credit saves five cents per gallon and is available to qualified small business refiners of low sulfur diesel fuels.

Type: Nonrefundable

Dates: No expiration currently defined.

Claims Process: File Form 8896, Low Sulfur Diesel Fuel

Production Credit with annual federal income tax returns.

This $1.01 per gallon tax credit (also known as the "Alcohol and Cellulosic Biofuel Fuels Credit") is available to biofuel producers.

Type: Nonrefundable

Dates: Biofuel used or sold 2018 - 2021.

Claims Process: File Form 6478, Biofuel Producer Credit

with annual federal income tax return.

This provision provides a tax credit for the sale of renewable electricity that is produced by certain renewable energy production property in the United States. The amount of the credit varies based on the production method and amount of energy produced and the reference price of the relevant fuel type.

Type: Nonrefundable

Dates: No expiration currently defined.

Claims Process: File Form 8835, Renewable Electricity Production Credit with annual federal income tax return.

This credit saves from $4,000 to $8,000 and is available to original owners or lessees of certain alternative fuel vehicles. The credit is treated as a personal credit unless it is attributable to depreciable property used for business purposes. In that case, it is treated as a general business credit.

Type: Nonrefundable

Dates: 2006 - 2021

Claims Process: File Form 8910, Alternative Motor Vehicle

Credit with your federal income tax return.

This credit saves between $2,500 and $7,500 depending upon the vehicle's battery capacity. To see if your vehicle qualifies and calculate your credit amount, use the EPA's EV Tax Credit Calculator. Individuals or businesses who purchased and used a qualified all-electric or plug-in hybrid vehicle on or after 2010 qualify for this credit. See IRS Qualified Plug-In Electric Drive MotorVehicles (IRC 30D) for the latest updates.

Type: Nonrefundable

Dates: EV acquired between 2010 and 2022

Claim Process: File Form 8834, Qualified Electric Vehicle Credit with your federal income tax return in the year you purchased and began using your electric vehicle.

This credit saves up to $7,500 for qualified plug-in electric drive two- and four-wheeled motor vehicles. Individuals and business are eligible.

Type: Nonrefundable

Dates: EV acquired between 2010 and 2021

Claim Process: File Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit with your federal income tax return.

This is a Section 45Q tax credit available to businesses that purchase and use carbon capture and sequestration mechanisms. The credit amount is calculated per metric ton of carbon oxide captured. To determine the credit rates, refer to IRS Form 8933, Carbon Oxide Sequestration Credit instructions.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: File Form 8933, Carbon Oxide Sequestration Credit, with your federal income tax return.

This general business tax credit can save $1,000 or $2,000 and is available to qualified contractors who sell or lease a home to someone planning to use it as a residence during the tax year. The credit is determined by how many of the specified energy saving requirements are met. See Instructions for Form 8908 for requirements.

Type: Nonrefundable

Dates: Homes sold or leased after 2021 and before 2033

Claims Process: File Form 8908, Energy-Efficient Home

Credit, with annual federal income tax returns.

This deduction, (also known as the "Commercial Building Energy-Efficient Tax Deduction") saves up to $1.88 per square foot and is available to building owners that purchase and install qualifying energy-efficient equipment. Tenants can also claim the credit if they make qualified construction expenditures to the building.

Type: Nonrefundable

Dates: Property placed into service on or before December 31, 2020

Claims Process: To claim the deduction, building owners must obtain a certification stating that the property meets all the

requirements. Owners must use a certified software to calculate energy and consumption amounts. See 179D Commercial

Buildings Energy-Efficiency Tax Deduction for a list of certified software.

Many business owners aren't aware that they could qualify for several energy tax credits. Saving money via tax credits is an opportunity to reinvest those savings into your business. Working with an energy tax advisor can help you get a clear view of your energy bills, find hidden fees, and leverage all the energy tax credits your business is eligible for. To begin saving with energy tax credits, contact our tax credit services experts today.

Armanino has the industry expertise, tax credit experience and track record of customer satisfaction to best advise your tax credit incentive strategy and compliance needs.

Contact us today for a free assessment.