Step 1: Plan Your Balance Sheet

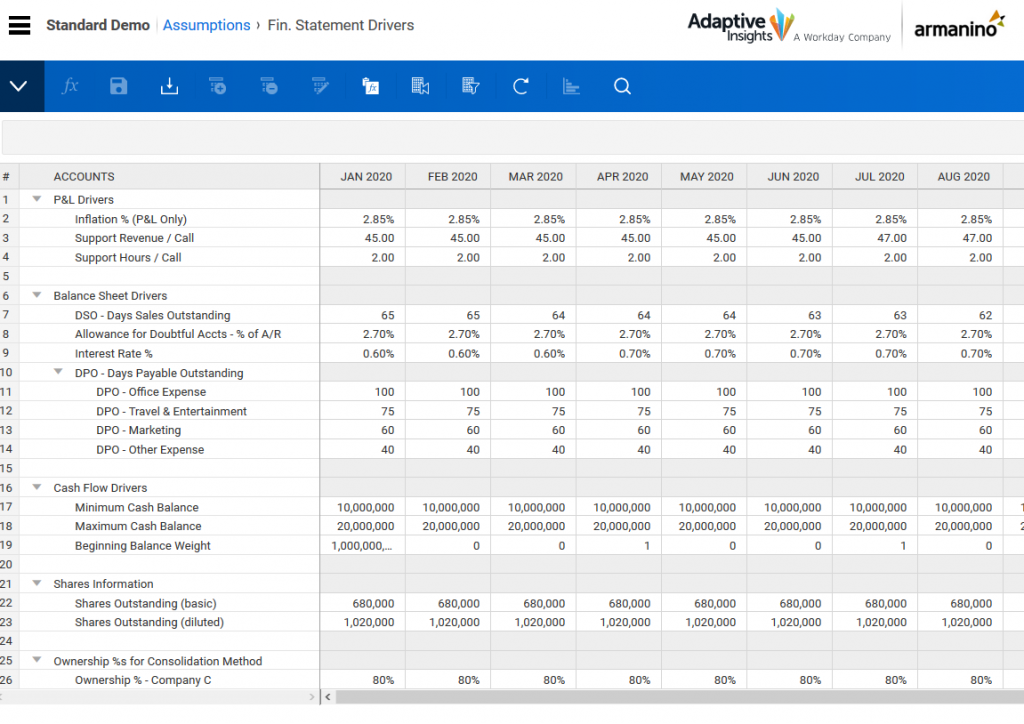

Most clients have a good set of models for their income statement, but some have not spent a lot of time on planning their balance sheet. Basic balance sheet planning includes, at a minimum, assumptions and drivers for receivables and payables. Utilize days sales outstanding to project your accounts receivable and days payable outstanding for accounts payable, among others. Assumptions for a balance sheet might look like this below.