A multinational consumer goods company with several foreign entities did not have a proper transfer pricing policy in place.

Armanino had several conversations to establish a transfer pricing policy to match the value chain and risk profile of each entity of the company.

By working with our transfer pricing team, the company was able to save a significant amount in taxes paid in a high-tax foreign jurisdiction.

A multinational consumer goods company with several foreign entities did not have a proper transfer pricing policy in place since foreign sales compared to U.S. sales historically were not as material. However, the company had intercompany transactions with related parties operating in high-risk, high-tax jurisdictions.

The current pandemic impacted the businesses in unforeseen ways. The U.S. headquartered company was incurring losses, additional COVID-19 expenses, and additional manufacturing expenses due to the shutdown of its facilities. Meanwhile, the foreign entities have historically been profitable, earning high operating margins, which resulted in higher foreign taxes for the company.

Without a proper transfer pricing policy in place, the company faced huge audit risk and higher foreign taxes. Additionally, the current pandemic situation added more strain to the liquidity of the parent company. Post-pandemic, tax authorities may focus on scrutinizing the transfer pricing policies and outcomes of taxpayers to differentiate between the COVID-19 impact versus any non-COVID-19 related factors. Therefore, the company needed to think about aligning the transfer pricing policy with the value chain of the company and also factoring in the appropriate impact of the pandemic.

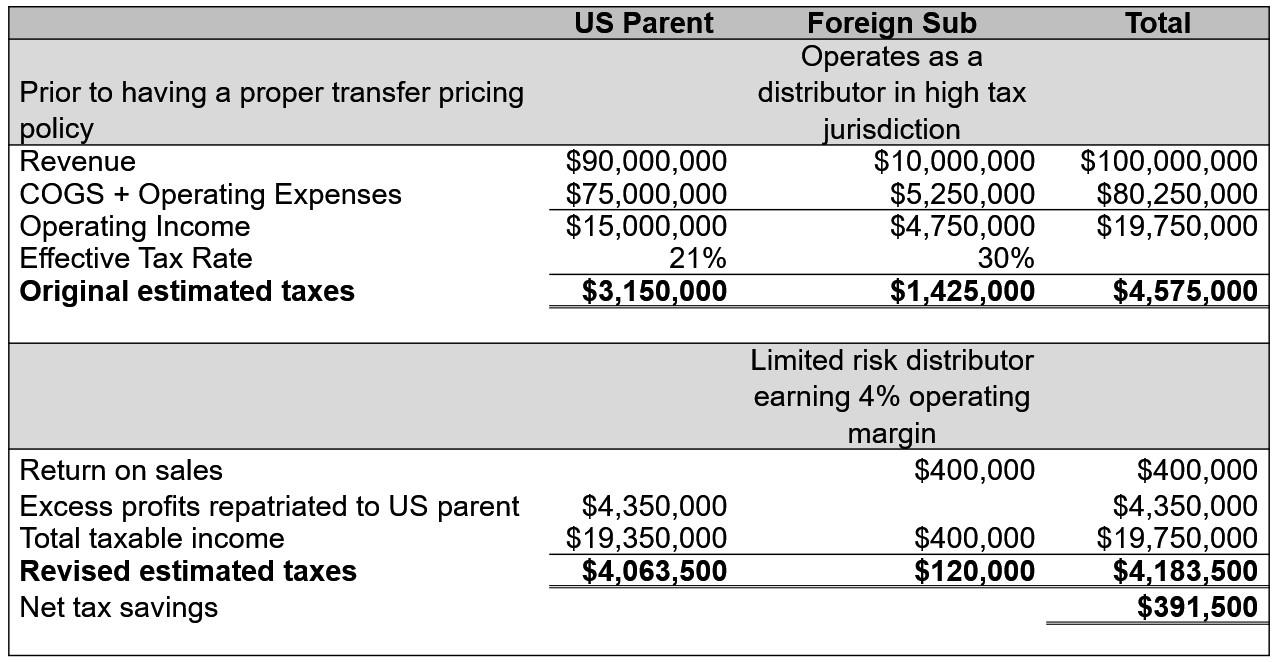

Armanino had several conversations to establish a transfer pricing policy to match the value chain and risk profile of each entity of the company. There were significant expenses in the U.S. as the headquarters company. The U.S. also oversaw the operations of the foreign entities, and the foreign entities had limited roles in performing the buy/sell function. All the strategic functions including the negotiation of sales contracts and marketing decisions were undertaken by the parent company. Therefore, it was appropriate to recharacterize the foreign entity as a limited risk distributor. After revising the transfer pricing policy for one foreign subsidiary, the company was able to recognize significant tax savings and reduce the strain on liquidity by repatriating excess profits to the parent company.

By working with our transfer pricing team, the company was able to save a significant amount in taxes (almost $400K) paid in a high-tax foreign jurisdiction. In the current pandemic situation, having a proper transfer pricing policy in place helped the company utilize the losses in the parent company to offset income being moved from high-tax jurisdictions.

Download File