A multinational consumer goods company with several foreign entities did not have a proper transfer pricing policy in place.

Armanino had several conversations to establish a transfer pricing policy to match the value chain and risk profile of each entity of the company.

By working with our transfer pricing team, the company was able to save a significant amount in taxes paid in a high-tax foreign jurisdiction.

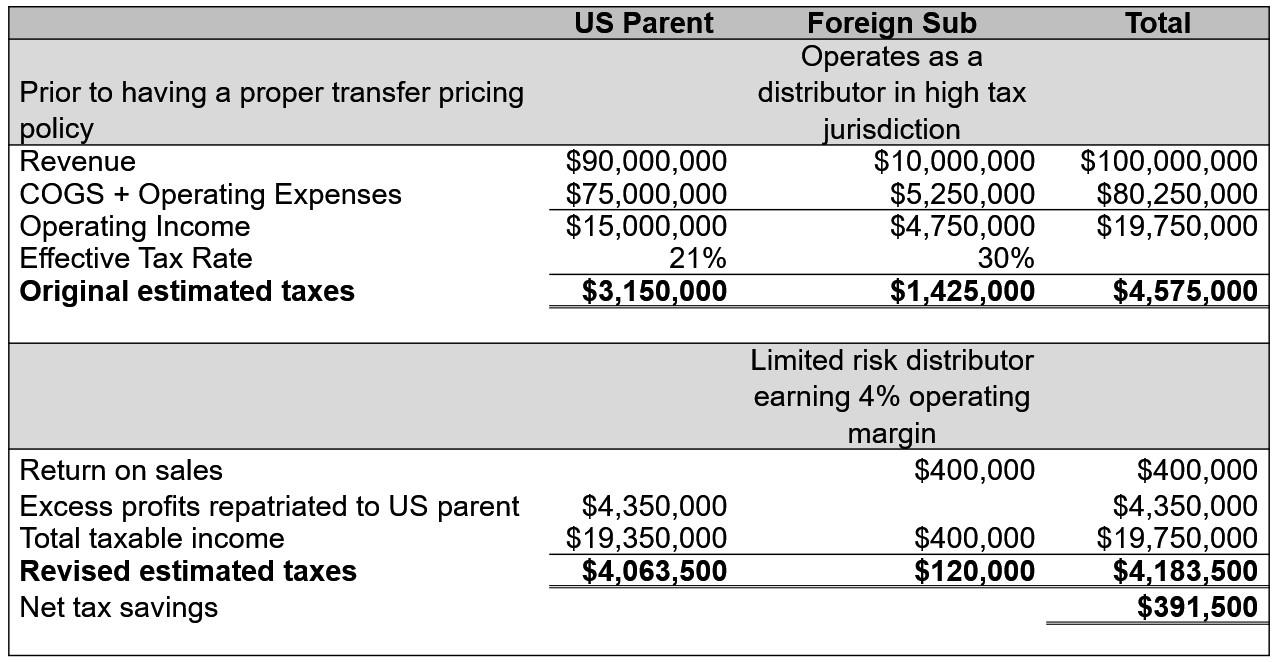

A multinational consumer goods company with several foreign entities did not have a proper transfer pricing policy in place since foreign sales compared to U.S. sales historically were not as material. However, the company had intercompany transactions with related parties operating in high-risk, high-tax jurisdictions.

The U.S. headquartered company was incurring losses and additional manufacturing and import expenses due to volatile market conditions. Meanwhile, the foreign entities have historically been profitable, earning high operating margins, which resulted in higher foreign taxes for the company.

Without a proper transfer pricing policy in place, the company faced huge audit risk and higher foreign taxes. Additionally, the current global supply chain challenges added more strain to the liquidity of the parent company. They needed to think about aligning the transfer pricing policy with the value chain of the company and also factoring in the appropriate impact of the economic climate.

By working with our transfer pricing team, the company was able to save a significant amount in taxes (almost $400K) paid in a high-tax foreign jurisdiction. By having a proper transfer pricing policy in place, the company could utilize the losses in the parent company to offset income being moved from high-tax jurisdictions.

By working with our transfer pricing team, the company was able to save a significant amount in taxes (almost $400K) paid in a high-tax foreign jurisdiction. In the current pandemic situation, having a proper transfer pricing policy in place helped the company utilize the losses in the parent company to offset income being moved from high-tax jurisdictions.

Download File