Innocura Nephrology is an integrated national nephrology practice driven to advance patient care, strengthen practice operations and empower nephrologists to thrive.

As the company brought nephrologist practices under the Innocura umbrella, Excel-based manual accounting processes were laborious across multiple entities and error prone.

Armanino equipped Innocura for streamlined multi-entity, multi-location accounting with Sage Intacct ERP implementation and software managed services.

Sage Intacct simplified accounting across practices — saving Innocura time and headcount, relieving the administrative burden on doctors and paving the way for future growth.

Innocura Nephrology was born out of rising operational costs, growing HIPAA complexity and the healthcare industry's shift toward value-based care. The company was established in 2022 to build a national nephrology practice that would help smaller, clinically excellent providers thrive under one integrated umbrella — handling the administrative burden while providing the tools and infrastructure to enable success.

As nephrology practices started to come aboard, accounting “as usual” became untenable. Innocura used Excel spreadsheets for its accounting functions across each practice, which was labor-intensive and prone to manual mistakes when staff pulled formulas between spreadsheets and files. And consolidating results in Excel didn’t preserve invoice history and other documentation required for audits and quality of earnings reporting.

It was time for a modern enterprise resource planning (ERP) solution. Sage Intacct’s cloud-based healthcare financial management software answered the demand for accounting and finance functions under one platform. By centralizing functions like AP/AR, reporting and budgeting, Sage Intacct enables healthcare organizations to scale and manage finances seamlessly across entities and locations. But was it right for Innocura?

The company considered its other top options: a million-dollar investment with Workday or Oracle. But either would be overkill for the practices in the Innocura group. And as they grew, Innocura didn’t want to change the system again in two years. So finding a solution that wasn’t too complex in the beginning yet delivered sophisticated capabilities was the goal. This would enable one chart of accounts for all entities in the same system, making life easier going forward.

Sage’s automation and other built-in components, such as automated bank reconciliations, resonated with Innocura. And Hovermann knew the company’s private equity investors had implemented Sage at several of their other healthcare companies and had a good experience overall with the product and cost.

Armanino’s recommendation also came into play. Hovermann and Armanino’s CFO Advisory team had worked on a number of ERP implementations at different healthcare companies.

“Armanino had been a key facilitator for me over my last couple of CFO roles, and they always had good solutions for me to consider."

Sage Intacct was no exception.

Innocura also turned to Armanino for the implementation. The firm’s long history as a top Sage Intacct value-added reseller (VAR) and healthcare experience were top reasons, but most important was Hovermann’s previous experience with the CFO Advisory team. This included the ability to call Armanino whenever he needed help.

“That type of lifeline is really great. Getting things done right is what gave me confidence that this would work.”

With the go-ahead for Sage Intacct, Innocura opted for a “plain vanilla” type of implementation.

“The main issue is that we started de novo. We didn’t have an existing chart of accounts or accounting policies. We elected to implement an off-the-shelf version of Sage Intacct so as not to prevent us from modifying Sage in the future as we define our accounting policies.”

Although Sage Intacct offers HIPAA-compliant dashboards and the ability to integrate electronic health record (EHR) systems, Innocura opted to keep accounting and patient data separate. All records for billing would be stored in EPIC, an EHR software for managing patient records and clinical documentation. They’d move the numeric revenue details into Sage through an upload and not store any of the HIPAA or SOX compliance data in Sage.

After a four-month implementation with “no hiccups,” Innocura added accounts, starting with accounts payable.

“The Armanino implementation team understood both Sage and accounting and was great to work with as there are still dozens of decisions to make.”

Hovermann also enlisted Armanino’s Application Managed Services to fine-tune the chart of accounts. For one practice, for example, revenue needed to be booked in accounts receivable in five separate sections. With the Managed Services team’s help, Innocura was able to add the accounts in the system and get them uploaded and structured in under an hour.

Despite wanting to hold onto old processes, Hovermann’s staff soon recognized the benefit of combining bill paying with accounting versus paying bills, backtracking and figuring out how to book it from an accounting standpoint.

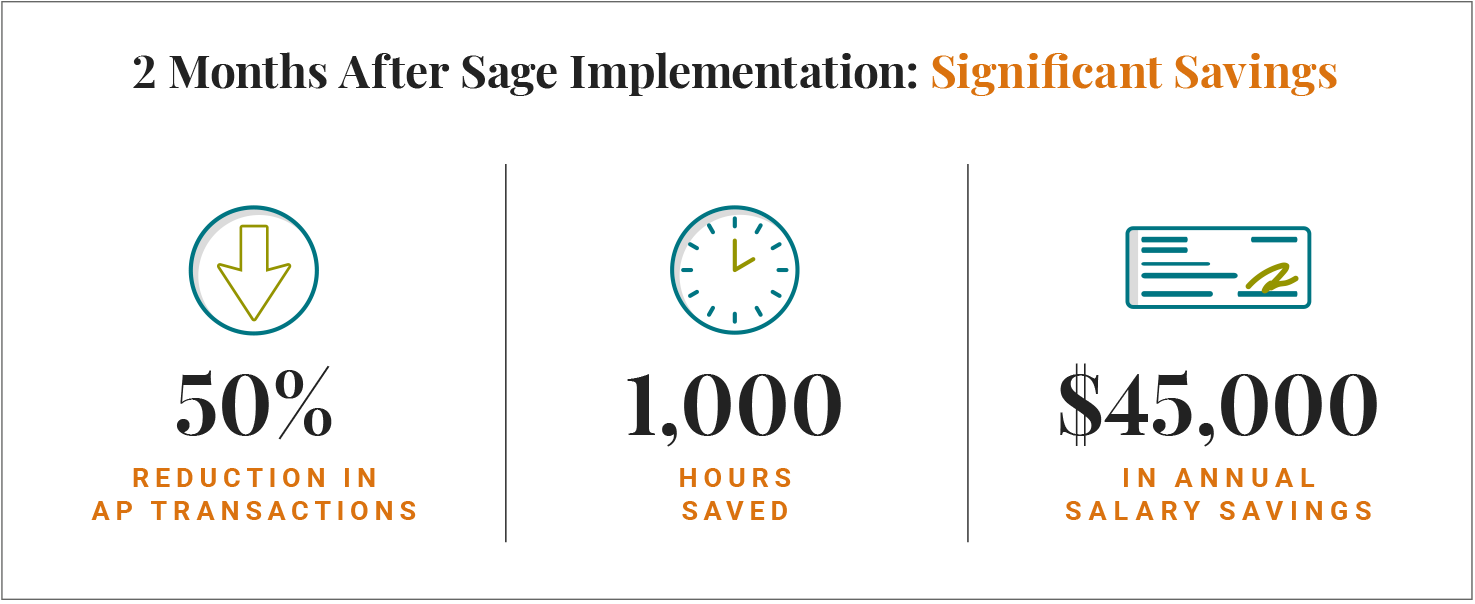

As for the numbers, total transactions in AP have been roughly cut in half since staff are no longer making payments separately from accounting. Now the process consists of updating all vendor information with bank account information, downloading a matcher file, updating and uploading it in the bank account to make all payments via Sage. Over the course of a year, Hovermann estimates they’ll save the equivalent of half a full-time accountant or AP specialist — about 1,000 hours and $45,000 in salary.

Doctors are also seeing benefits. They can focus on patient care instead of the administrative burden of running a practice. Plus, they're getting information faster via dashboards that show at a glance how many patients they've treated and the relative value units (RVUs), a standardized measure used to quantify the resources needed to deliver medical services. Because nephrologists work in three different care sites — the hospital, their office and in the dialysis units — they can easily see their productivity in each of these facilities.

“The dashboards are about volume and productivity. It's a scorecard of sorts that doctors can look at. We can benchmark them against the budget and also against the averages for their area in the country.”

What are next steps for Innocura? The company’s first significant milestone will be reporting Q2 results by August. To that end, they’ve achieved their first “mini” goal: getting over 2,000 accounts payable into the system, making and documenting all payments and printing checks out of Sage. The company also hired an accounting manager responsible for documenting all processes and ensuring everything in Sage is set up well so they can be audited at the end of 2025.

Innocura intends to take full advantage of Sage’s dashboard features, especially management and board reporting, and an audit portal. Hovermann also wants to add billing and revenue information on dashboards, so doctors can see what they're producing and where they stand on a potential bonus.

Also in store for doctors are potentially more frequent bonuses. In many private practices, they get their productivity bonus once a year. With Sage, Innocura can calculate this more often and on an accrual basis, paying doctors a bonus either two or four times a year based on their productivity.

“We selected Sage Intacct because it met our need for consolidating more entities than I think we will reach. The system offers quite a bit of automation for bank reconciliations and lease schedules, which will help our small team manage accounting. Sage has definitely lived up to the high expectations Armanino set for it.”

See what’s possible when you leave manual processes behind. Learn how our Sage Intacct experts can help you transition seamlessly to Sage Intacct accounting software tailored for healthcare — bringing clarity, control and scalability to your finance operations, whatever the size of your healthcare organization.

Unlock the benefits of total visibility and streamlined workflows. Contact our Sage Intacct experts today to learn how to start driving innovation for your organization.