A SOX compliance assessment isn’t just a box to check ― it’s a strategic opportunity to strengthen your company’s financial foundation. By understanding how the process works and how to prepare, you can turn this regulatory requirement into a competitive advantage.

A SOX compliance assessment is an in-depth evaluation of an organization’s internal controls related to financial reporting. It assesses management's internal control structure and control effectiveness to determine how strong the internal control environment is at preventing financial misstatement.

The assessment is intended to ensure your company’s compliance with the Sarbanes-Oxley Act of 2002 (SOX), which was passed after multiple accounting scandals were discovered at large publicly traded organizations in early 2000. SOX imposes strict governance, financial transparency and accountability requirements to protect investors from corporate fraud.

The following organizations must conduct an annual SOX compliance assessment. Their internal control framework must be in place by the end of the fiscal year — in the first year and every year after.

Certain private companies may also be required to conduct a SOX compliance audit. They include:

Typically, a SOX compliance assessment involves two sets of “eyes.”

SOX Section 404(a) requires that management assess the effectiveness of ICFR as well as the control environment and financial reporting risks.

Due to the complexity of SOX reporting, many companies bring in an advisory firm for expertise to ensure compliance, provide benchmarking and improve control design and preparedness. Depending on their internal capabilities, companies may use a co-sourced arrangement — external SOX audit experts who work alongside your internal team — or a fully outsourced SOX compliance assessment. In either case, management is ultimately responsible for all decisions.

SOX Section 404(b) requires an external auditor’s opinion of management’s ICFR assessment. In other words, the external auditor verifies that your company’s ICFR is effective based on what management reports as part of the annual SOX assessment.

Keep in mind that an external auditor attestation is not always required. There are certain exemptions to the external audit attestation requirement, dependent on the size and reporting requirements of a company.

If your company goes public and you complete your IPO under emerging growth company (EGC) status — below a certain threshold of revenue or market capitalization — you get a bit of a grace period. Yes, you must conduct the annual management assessment of ICFR, but you’re exempt from the external auditor requirement for up to five years or until the company no longer qualifies as an EGC.

Note that you can’t use the same advisory firm for your SOX consulting and external audit. To maintain auditor independence and objectivity, SOX rules prohibit audit firms from providing certain non-audit services, including SOX compliance consulting, to their audit clients.

A SOX compliance assessment is a year-long process made up of eight key steps. Steps 1-7 are conducted by management or a SOX auditor hired on behalf of management. Step 8 is completed by an external auditor as part of your financial statement audit if required.

Preparation is critical, especially if this is your first year of SOX compliance. Companies preparing to go public or those with limited internal controls often choose to hire experienced SOX auditors from an advisory firm for guidance. These professionals can streamline the SOX implementation process, helping you establish and evaluate an effective control environment.

SOX auditors typically recommend aligning your controls with the Committee of Sponsoring Organizations of the Treadway Commission (COSO) framework. This widely used standard helps you design, implement and evaluate financial reporting and compliance controls. Once aligned, management reviews and approves the controls, ensuring a solid foundation for compliance.

The SOX compliance process spans the entire fiscal year, with these key steps:

The staggered timing and dual audits (SOX audit + external financial statement audit if required) offer more than compliance. This creates an opportunity for you to proactively spot risks, resolve control gaps and certify that all regulatory requirements occur before your year-end certifications. Done right, the SOX compliance process can set the tone for smoother audits in future years and reinforce trust in your financial reporting processes.

As mentioned in the timeline above, your CEO and CFO sign off on whether your ICFR is effective at year-end in management’s internal control assessment report. If you’re required to have an external financial statement audit, the external auditor will review your internal control assessment and issue one of the following opinions:

The financial statement audit report and SOX compliance report go together as part of your company’s annual 10-K filing. Once the filing is made to the SEC, the auditor's report becomes publicly available.

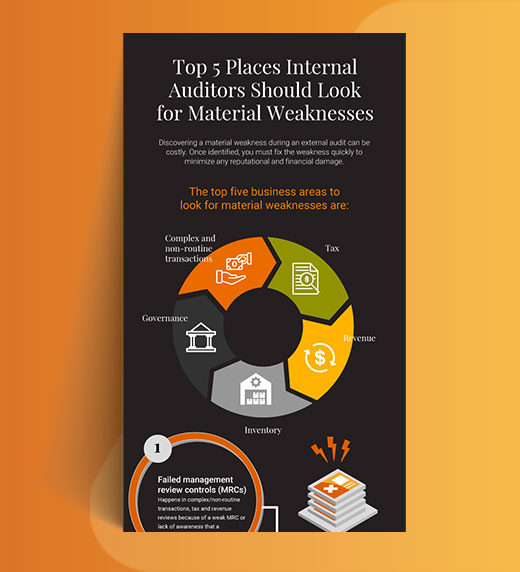

But what if the external auditor found material weaknesses and is preparing to issue an adverse opinion on your ICFR? You can still remediate the issue before the 10-K is filed — but only if remediation is completed by the end of the fiscal year. Remediation after that date can’t change the audit opinion for that year’s 10-K filing.

After year one, the SOX compliance process transitions to regular annual testing. Management is responsible for ongoing controls testing and documenting any changes, such as company acquisitions, new risks (e.g., migrating to cloud-based systems) or adjustments to key business processes (e.g., outsourcing a function like payroll). It’s essential to communicate these updates to your SOX auditor so they can include them in your annual SOX compliance assessment.

The SOX auditor or internal audit team will conduct walk-throughs of new controls and retest existing ones to ensure they are designed effectively and consistently operating as intended. They will also verify that any material weaknesses or significant deficiencies identified in previous audits have been addressed. Finally, your auditor will assess whether changes, such as new systems, processes, M&A activity, reorganizations or other initiatives, have been adequately integrated into your control environment.

A SOX compliance assessment can be a big nut to crack — no argument there. But there’s much you can do to help dodge headaches and make your yearly audit a smooth process:

Yes, SOX is a lot of work. But with the right support, it doesn’t have to be one big headache. Learn how our SOX compliance consultants can help you uncover and address vulnerabilities, streamline the compliance process and maintain an effective SOX 404 program.

Our seasoned audit experts can help you streamline your audit experience and strengthen your financials. Contact us today for a free scoping call to assess your needs.