The FASB issued ASU 2020-07 to increase the transparency of contributed nonfinancial assets for not-for-profit (NFP) entities through enhancements to the presentation and disclosure process. Prior to this regulatory update, many stakeholders and nonprofit financial statement users noted diversity in the presentation and disclosure of contributed nonfinancial assets by nonprofit entities.

Subtopic 958-605 laid out the revenue recognition standards for nonprofit entities. These standards didn’t include specific presentation requirements for contributed nonfinancial assets or specific disclosure requirements for contributed nonfinancial assets other than contributed services.

Nonfinancial assets include fixed assets (such as land, buildings and equipment); the use of fixed assets or utilities, materials and supplies; intangible assets; services; and unconditional promises of those assets.

The amendments in ASU 2020-07 seek to improve financial reporting by providing new presentation and disclosure requirements about contributed nonfinancial assets for nonprofits, including additional disclosure requirements for recognized contributed services. The amendments in ASU 2020-07 won’t change the recognition and measurement requirements in Subtopic 958-605 for those assets

The amendments in this update are effective for annual periods beginning after June 15, 2021, (e.g., FYE June 30, 2022, or FYE December 31, 2022). They should be applied on a retrospective basis and early adoption is permitted.

Transition disclosures are required in the first annual period of adoption. These disclosures should include the nature of and reason for the change in accounting principle. They should also state the method used to apply the change with a description of the prior period information that has been retrospectively adjusted. Finally, it should explain the effect of the change on the relevant financial statement line items.

The enhanced presentation and disclosure requirements are as follows:

* Principal market - The market with the greatest volume and level of activity for the asset or liability

** Most advantageous market - The market that maximizes the amount that would be received from the sale of the asset or minimizes the amount that would be paid to transfer the liability, after considering transaction costs and transportation costs

|

NFP Entity |

||||

| Without Donor Restrictions | With Donor Restrictions | 20X2 Total | 20X1 Total | |

| Support and revenue | ||||

| Contributions of cash and other financial assets | $1,000,000 | - | $1,000,000 | $954,000 |

| Contributions of nonfinancial assets | $608,000 | - | $608,000 | $546,000 |

ASU 2020-07 isn’t prescriptive on how the information should be disclosed in the footnotes. FASB provides two alternative example formats to serve as a guide.

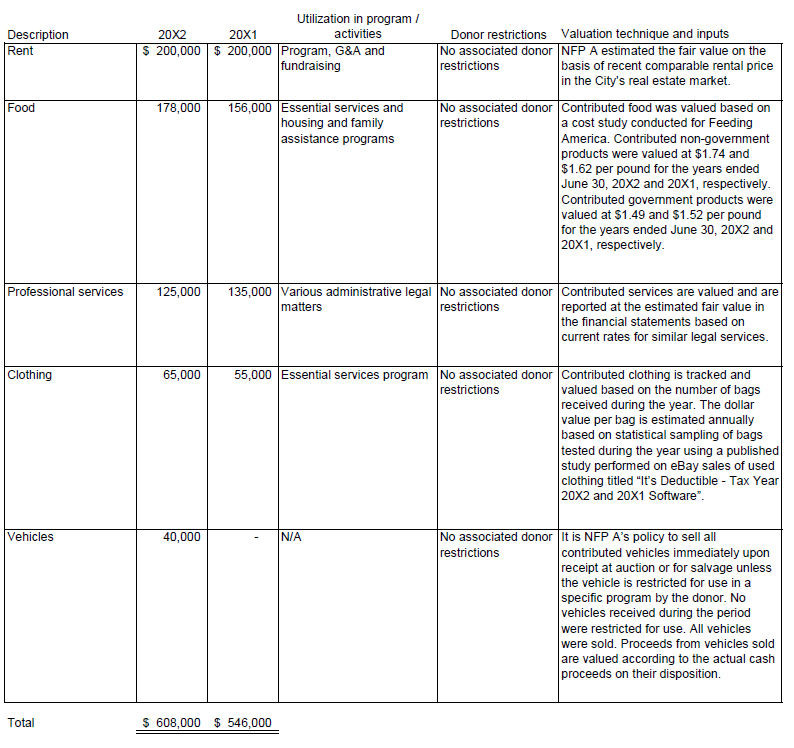

Contributed Nonfinancial Assets

For financial years ending on June 30, contributed nonfinancial assets recognized within the statements of activities include:

| 20X2 | 20X1 | |

| Rent | $200,000 | $200,000 |

| Food | $178,000 | $156,000 |

| Professional services | $125,000 | $135,000 |

| Clothing | $65,000 | $55,000 |

| Vehicles | $40,000 | - |

| $608,000 | $546,000 |

In this format, NFP A recognized contributed nonfinancial assets within revenue, including contributed rent, food, professional services, clothing and vehicles. Unless otherwise noted, contributed nonfinancial assets didn’t have donor-imposed restrictions.

Rent

The contributed rent is used for programs (75%), general and administrative functions (15%) and fundraising (10%) activities based on square footage allocation. NFP A estimated the fair value based on a recent comparable rental price in the city’s real estate market.

Food

Contributed food from government and non-government sources was utilized in the essential services and housing and family assistance programs. Contributed food was valued based on a cost study conducted for Feeding America. Contributed non-government products were valued at $1.74 and $1.62 per pound for the years ending on June 30, 20X2 and 20X1, respectively. Contributed government products were valued at $1.49 and $1.52 per pound for the years ending on June 30, 20X2 and 20X1, respectively.

Professional services

The contributed services recognized are comprised of professional services from attorneys advising NFP A on various administrative legal matters. Contributed services are valued and are reported at the estimated fair value based on current rates for similar legal services.

Clothing

Contributed clothing was utilized in the essential services program. Contributed clothing is tracked and valued based on the number of bags received during the year. The dollar value per bag is estimated annually based on statistical sampling of bags tested during the year using a published study performed on eBay sales of used clothing titled “It’s Deductible - Tax Year 20X2 and 20X1 Software”.

Vehicles

It is NFP A’s policy to sell all contributed vehicles immediately upon receipt at auction or for salvage unless the vehicle is restricted for use in a specific program by the donor. No vehicles received during the period were restricted for use. All vehicles were sold and valued according to the actual cash proceeds on their disposition.

Contributed nonfinancial assets received during the year were as follows:

If your nonprofit receives nonfinancial asset contributions, you should begin thinking about how your financial reporting may be impacted. If you receive a material amount of contributed nonfinancial assets but are not currently presenting the contributed nonfinancial assets separately from cash or other financial asset contributions, this may be a significant change in your reporting. You may also need to provide additional explanation to key stakeholders.

As a result of these enhanced disclosures, you may have to gather information and data that you never had to before. For some entities, this may be a more arduous task, and coordination with other departments such as fundraising and development may be needed.

If you have questions about how ASU 2020-07 could affect your organization, reach out to our dedicated nonprofit audit experts.