As a top provider of accounting and consulting services to nonprofit organizations, Armanino has been extremely engaged in providing guidance and thought leadership to help nonprofit leaders navigate the financial challenges brought on by the COVID- 19 pandemic. We conducted a survey of nonprofit organizations in the United States between mid-May and early June. We received approximately 160 responses, which are summarized in this report.

We received responses from a wide variety of organizations, with social services providers and private education making up the largest group of respondents. A survey with more responses from other sectors, particularly the arts, might yield different results. The majority of responding organizations were located in California or Texas.

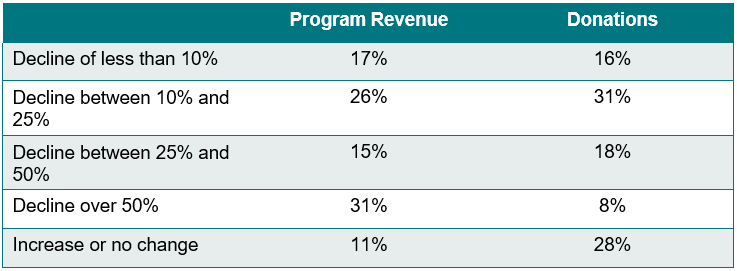

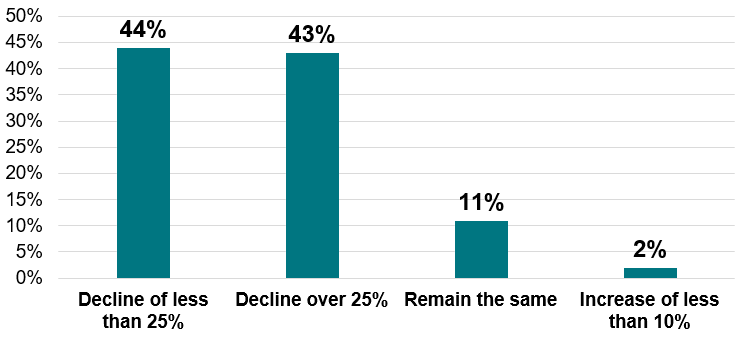

During the initial period of widespread closures, organizations were experiencing a greater reduction in their program revenue streams than in donations. Only 28% of respondents indicated that program revenues had increased, not changed or declined less than 10%, while 44% of respondents indicated that donations had increased, remained steady or declined less than 10%.

This could certainly change as the economic impact of the pandemic lingers, but for now, it is a relatively hopeful sign for organizations that depend more on contributions. “Relative” is the operative word here, as these results still indicate that 57% were experiencing decreases in contribution revenue beyond 10% and 43% expect overall revenues to decline by more than 25% through 2021.

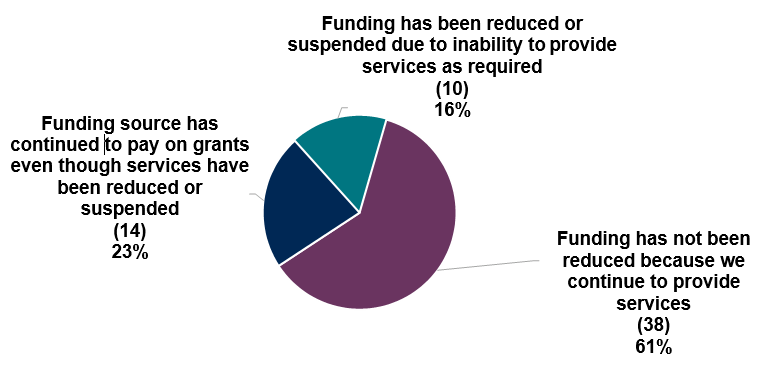

Governmental funding has remained a stable source of funding for the survey respondents, with only 16% reporting that funding has been reduced as a result of an organization’s inability to provide services as required. This was driven in part by the Office of Management and Budget’s memo M-20-17 allowing funds to be used under grants, even if operations were interrupted. It also reflects the fact that government funding tends to be a greater source of support for social services organizations, many of which have continued operations as providers of “essential services.”

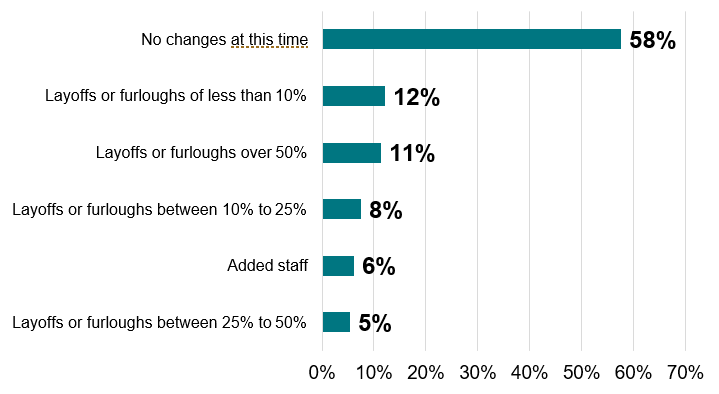

As seen in the previous chart, approximately 60% of recipients of governmental funding have continued to provide services. About 47% of our respondents receive government funds. However, the response on retention of staff was similar for the overall group, not just government-funded organizations. Overall, 64% of respondents indicated that they had not made changes or had added staff.

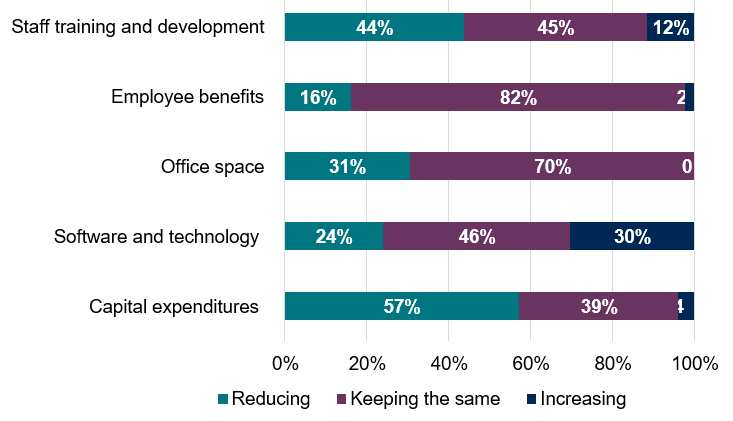

Nonprofit finance leaders are looking at a variety of other ways to alter their budgets to respond to the changes. As one might expect, organizations are looking to delay capital expenditures and reduce costs that could be considered discretionary, such as staff training. Organizations are also looking at office space, particularly with so many working with some success at home.

Almost one-third (30%) of organizations responding indicated that they intended to increase spending on software and technology to support the changing environment.

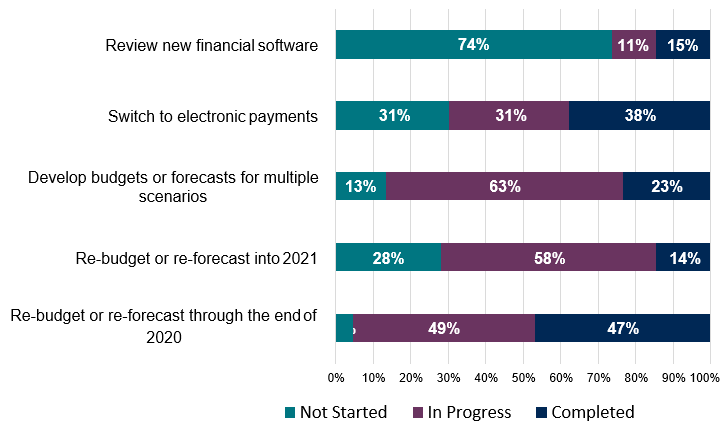

Organizations were already moving to electronic payments, with 38% already switched to that model and another 31% in progress. Electronic payment processing is a technology that most organizations have found easy to implement, either through their own banks or a cloud-based provider like Bill.com.

Given the state of the pandemic now (early July 2020), it appears that work-from- home solutions will be needed for quite some time. Organizations that have not yet adopted electronic payment processing should look at implementing the technology. While bank ACH transactions may have internal control limitations, cloud-based solutions frequently provide a better control environment than paper checks due to forced separation of duties.

Most organizations have focused on the need to update financial plans in response to expected changes in revenues. At the time of our survey, almost half had already completed a budget update or forecast, and almost all the remainder were in progress on this. As indicated by the response to the question regarding expectations for revenues into 2021, nonprofit leaders were also seeing the need to update their budget forecasts for next year.

About 87% of respondents were interested in looking at multiple scenarios, but only 23% had actually completed that during our survey period. This could be due to the timing and a need to think through possible scenarios; it might also be because scenario analysis can be very time-consuming when done in Excel.

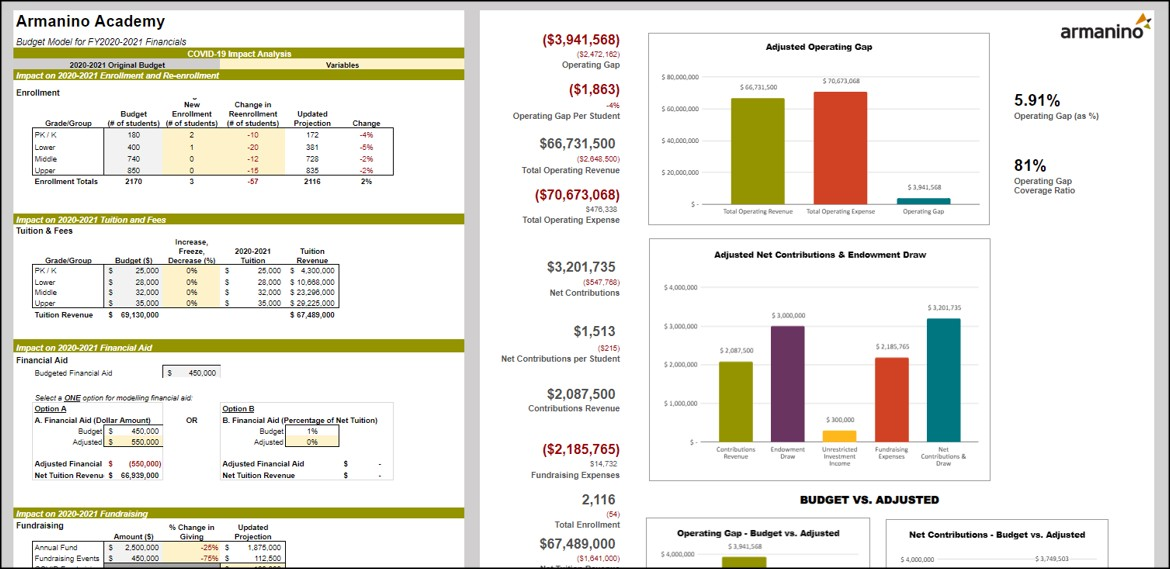

Since the survey was conducted, Armanino has launched a scenario tool for private schools and museums that draws on the benchmarking we have long provided to our clients. The tool is available as a free trial or with longer-term options including custom assistance and modeling.

On March 27, 2020, the president signed the CARES Act (H.R. 748), which included the Paycheck Protection Program (PPP). The PPP expanded the existing SBA loan program to allow small businesses with 500 or fewer employees, including certain nonprofits, veterans organizations and tribal concerns, to apply for loans that can be forgivable when used for payroll costs, interest on mortgages, rent and utilities.

Small businesses were first able to apply through a banking institution on April 3, 2020, for PPP loans intended to provide borrowers eight weeks of allowable expenses, but the program has been anything but simplistic. The SBA has issued 24 interim final guidance rules and 49 FAQs, along with multiple iterations of loan applications and instructions. Throughout the process, borrowers have struggled with determining the need criteria, how to maintain payroll, calculating FTEs, and many of the individual nuances that have been discovered along the way.

The PPP Flexibility Act (H.R. 7010) signed into law on June 5, 2020, included an extension of the eight-week covered period to 24 weeks and reduced the payroll costs threshold from 75% to 60% of the covered loan. The HEROES Act (H.R. 6800) passed by the House would have extended the PPP to all nonprofit organizations, but that legislation appears to have little traction in the Senate. As of July 6, 2020, approximately $130 billion was still available, and the program has been extended through August 8.

The PPP was a major focus of the survey, and most organizations who were able to take advantage of the program did so. Of our respondents, 81% applied for a PPP forgivable loan. Most who had not applied did so because they did not qualify, either because the organization was not a charitable organization or because it exceeded the 500-employee limit. About 36% of those who did not apply indicated that they did not need the funding. These organizations were from various sectors. A small number (5%) indicated that they had received a loan but had returned all or a portion of the funds or were considering doing so.

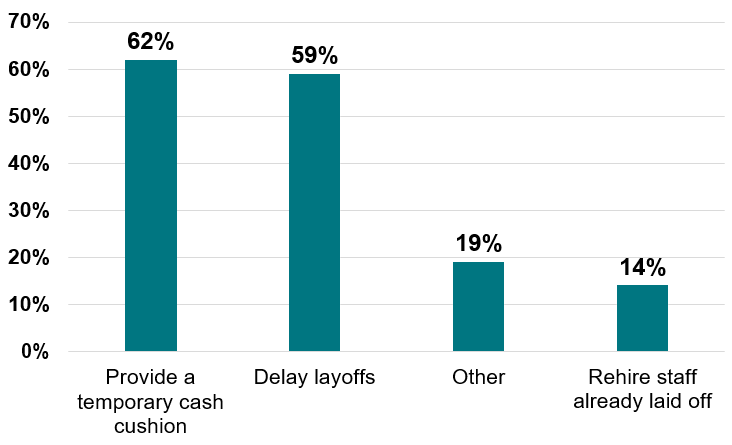

Our respondents primarily intended to use the funds as a cash cushion or to delay the need for layoffs.

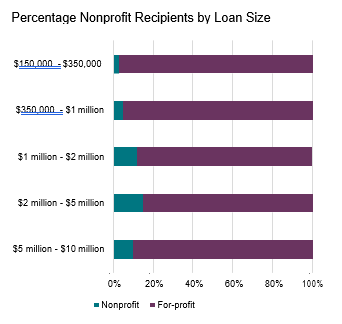

The SBA has released general information about the program, and nonprofit organizations made up about 6% of recipient organizations receiving more than $150,000. Over 40,000 nonprofits nationwide received loans greater than $150,000. This list is available on the Treasury website, so this is now public information for any organization receiving more than $150,000.

Note that the exact dollar amount has not been provided, but rather recipients are disclosed according to the bands shown at the right.

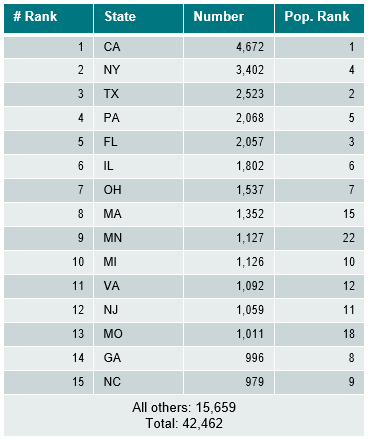

In comparison to their overall population, certain states received more PPP loans than might be expected. This could reflect more nonprofit organizations headquartered in those states or better access to capital.

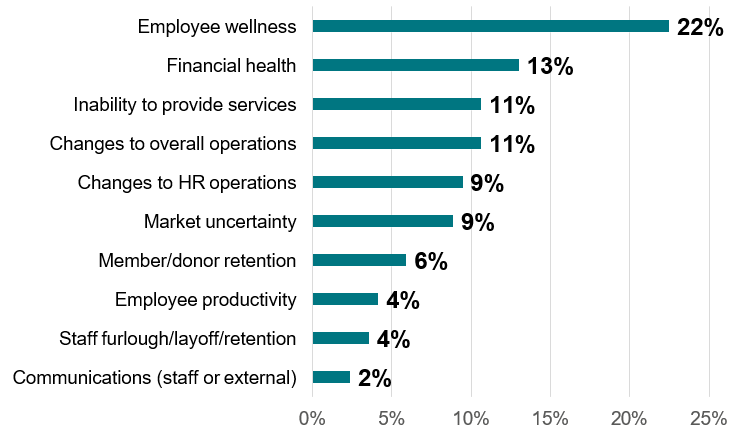

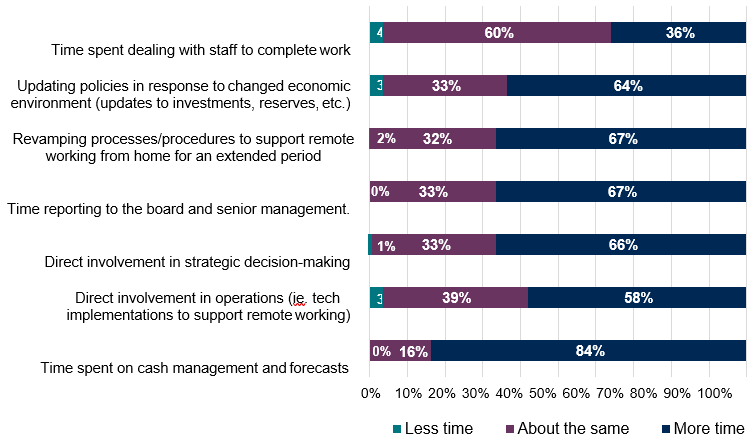

We also asked respondents to offer their thoughts on how their jobs might change. More than 50% of respondents expected to increase time spent in all but one of the areas we asked about. This suggests that organizations’ finance teams may be under a great deal of stress as needs for additional information and new procedures add to their existing workloads.

Nonprofit organizations have specialized audit, tax and operational needs that require specialized service. Armanino has been committed to the nonprofit sector since 1969, and we now work with more than 600 nonprofit clients. This hands-on experience gives our staff of CPAs and former CFOs a deeper understanding of the issues nonprofits face, so we’re able to meet their needs and help them fulfill their missions in the most efficient, cost-effective way possible.

Download White Paper