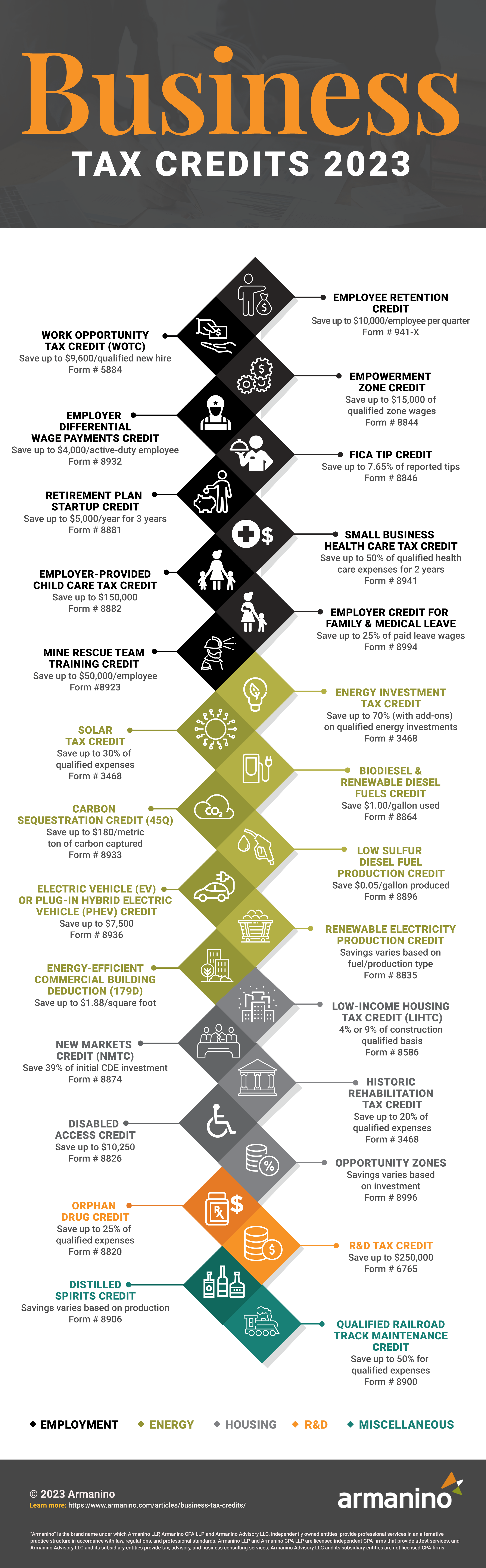

Business tax credits are money that can be subtracted, dollar for dollar, from owed business income taxes at state or federal levels. Business tax credits incentivize investment or provide assistance in these targeted areas:

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armaninollp.com with this graphic.

This federal tax credit is meant to help employers that suffer financial losses but continue to pay workers who are unable to perform their duties. It, like other CARES Act measures, rewards employers that keep employees on the payroll roster. This credit provides savings of up to $10,000/employee per quarter and is available for payroll from March 12 to December 31, 2020.

Type: Refundable

Dates: March 12, 2020 – December 31, 2020

Claim Process: File Form 941-X.

This federal tax credit provides tax savings to companies who employ individuals that face significant barriers to employment with savings up to $9,600/employee. Companies may qualify for this credit if they have first and/or second year wages paid to or incurred for targeted groups during the tax year.

WOTC-Eligible Worker Categories:

Type: Nonrefundable

Dates: Jan 1, 2015 - Dec 31, 2025

Claim Process: Request certification by filing IRS Form 8850, Pre-Screening Notice and

Certification Request for the Work Opportunity Credit with the state workforce agency within 28

days after eligible workers begin work. Calculate the credit using Form 5884, Work

Opportunity Credit, and include it when filing annual federal income tax returns.

This federal tax credit incentivizes hiring individuals that live and work in designated Empowerment Zones (EZs) – economically distressed areas identified by the federal government to encourage economic development in low-income and high-poverty areas. Empowerment Zones are one of three U.S. congressional designations that make up the Empowerment Zone Program to aid distressed urban and rural communities – the other two being Enterprise Communities (ECs) and Renewal Communities (RCs).

Employers eligible for Empowerment Zone tax credits can receive 20% of their qualified zone wages paid or incurred (up to $15,000 savings) during the calendar year for services performed by an employee while the employee is a qualified zone employee. See IRS Form 8844 for qualifying empowerment zone employees and wages.

Type: Nonrefundable

Dates: Jan 1, 1993 - Dec 31, 2025

Claim: File Form 8844, Empowerment Zone Credit with quarterly federal employment tax returns.

This federal tax credit, meant to alleviate the burden of military deployment, is available to employers that offer differential pay to employees entering active-duty uniformed service in the U.S. This credit saves 20% of up to $20,000 of differential pay made to eligible employees (i.e., up to $4,000/active-duty employee)

Type: Nonrefundable (part of the general business credit)

Dates: Effective after 2008

Claim Process: File Form 8932, Credit for Employer

Differential Wage Payments with annual federal income tax returns beginning in 2021. For earlier tax years,

use the applicable prior form version.

This federal tax credit (also known as the "Credit for Portion of Employer Social Security Paid with Respect to Employee Cash Tips") typically equals the amount of employer Social Security or Medicare taxes paid on or incurred by the employer on tips received by the employee. (i.e. Save up to 7.65% of reported tips.) It is only available for employers working in entities where tipping is customary for providing food or beverages.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8846, Credit for Employer Social

Security and Medicare Taxes Paid on Certain Employee Tips with annual federal income tax returns.

This federal tax credit (also known as the “Small Employer Pension Plan Credit”) saves up to $500, or 50% of employee pension startup costs. To qualify, companies must employ 100 or fewer people who have received at least $5,000 in compensation. The company must not have had an existing 401(k) or other retirement plan in place for at least three years.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8881, Credit for Small Employer

Pension Plan Startup Costs with annual federal income tax returns for the first three years of the newly

started pension plan.

This federal tax credit (also known as "Credit for Small Employer Health Insurance Premiums") applies to employers paying at least half of the premiums for their employees’ health coverage. It saves up to 50% of employee health coverage expenses for qualifying employers that meet certain criteria and purchase coverage through the Small Business Health Options (SHOP) program This credit only applies to companies who employ fewer than 25 employees and pay average wages of less than $50,000 a year.

Type: Refundable

Dates: No expiration currently defined

Claim Process: File Form 8941, Credit for Small Employer

Health Insurance Premiums with annual federal income tax returns.

This federal tax credit saves 25% of qualified expenditures paid for employee-provided childcare -- up to $150,000 maximum credit savings per year. Employers themselves may also be eligible to receive the same benefits as their employees if the company is incorporated.

Type: Refundable

Dates: No expiration currently defined

Claim Process: File Form 8882, Credit for Employer-Provided Childcare Facilities and Services with annual

federal income tax returns.

This federal tax credit, which applies to qualified employers who paid leave to an employee for family or medical-related reasons, could save between 12.5% and 25% of the leave pay provided, depending on the employee's pre-leave pay. To qualify, the employee must have been on payroll for at least one year and the employer must have provided leave pay for at least two weeks. See the IRS FAQ for more information.

Type: Refundable

Dates: Dec 31, 2017 - Dec 31, 2025

Claim Process: File Form 8994, Employer Credit for Paid Family

and Medical Leave with annual federal income tax returns.

This federal tax credit applies to the cost of mine rescue training programs -- either paid or incurred -- saving up to $50,000 for each qualified employee. Employers may claim this credit if they employ individuals as miners in U.S. underground mines.

Type: Nonrefundable

Dates: Effective through Dec 31, 2022

Claim Process: File Form 8923, Mine Rescue Team Training

Credit with annual federal income tax returns.

This federal tax credit (also known as the "Rehabilitation, Energy & Reforestation Investment Credit," “Renewable Energy Credit,” “Green Energy Credit,” “Clean Energy Credit,” “Wind Energy Credit,” “Geothermal Energy Credit" or "Energy Investment Tax Credit (ITC)") saves up to 70% (with add-ons) of the total purchase and installation costs of certain renewable energy properties. This includes credits for rehabilitation, energy, qualifying advanced coal projects, qualifying gasification projects and qualifying advanced energy projects – geothermal systems, solar technologies, fuel cells, small wind turbines, microturbines, waste energy recovery, and combined heat and power (CHP).

Type: Nonrefundable

Dates: Energy properties where construction began after Jan 1, 2020

Claim Process: File Form 3468, Investment Credit with

annual federal income tax returns in the year the energy property was placed in service.

This federal tax credit (also referred to as the "Solar Investment Tax Credit") saves up to 30% of costs for new solar energy systems where a non-tax-exempt business or individual owns (not leases) and uses the system in the United States.

The ITC savings percentage scales down as follows:

The IRS qualifies construction as “started” when 5% of project costs have been incurred. Solar-powered units that illuminate, heat/cool water, or generate electricity along with their respective storage equipment, installation, and labor costs are eligible. (Solar systems for heating swimming pools or hot tubs are not eligible.) See the U.S. Department of Energy Residential and Commercial ITC Factsheets for eligibility and savings specifics and exceptions.

Several U.S. states and territories additionally offer solar tax incentives or rebates. California, Minnesota, Texas, New York, Colorado, and Oregon offer over 100 solar incentives. Visit the Database of State Incentives for Renewables & Efficiency (DSIRE) for program details. If you’re considering solar lighting or solar panels, be sure to leverage both federal and state tax incentives.

Type: Nonrefundable

Dates: Solar properties where construction began after Jan 1, 2020

Claim Process: File Form 3468, Investment Credit with

annual federal income tax returns in the year the solar system was placed in service.

Note: The Solar Tax Credit (IRS Form 3468, ITC) applies for businesses while the Residential Solar Energy Credit (IRS Form 5695) applies for individual homeowners. The rules are similar, but differ slightly.

This federal tax credit saves $1.00 per gallon and is available to businesses and individuals who use biodiesel, agri-biodiesel or renewable diesel in their vehicles or as the on-road fuel for their business or trade.

Type: Nonrefundable

Dates: Biofuel used or sold 2018 - 2022

Claim Process: File Form 8864, Biodiesel and Renewable Diesel

Fuels with annual federal income tax returns.

This is a Section 45Q federal tax credit available to businesses that purchase and use carbon capture and sequestration mechanisms. The credit amount is calculated per metric ton of carbon oxide or carbon dioxide captured – with savings up to $180/metric ton. There’s currently no limit on maximum savings. To determine the credit rates, refer to IRS Form 8933, Carbon Oxide Sequestration Credit instructions.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8933, Carbon Oxide Sequestration

Credit with annual federal income tax returns.

This federal production tax credit (PTC) saves five cents ($0.05) per gallon and is available to qualified small business refiners of low sulfur diesel fuels.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8896, Low Sulfur Diesel Fuel

Production Credit with annual federal income tax returns.

This federal tax credit saves between $2,500 and $7,500 depending upon the vehicle's battery capacity. To see if your vehicle qualifies and calculate your credit amount, use the EPA's EV Tax Credit Calculator. Individuals or businesses who purchased and used a qualified all-electric (EV) or plug-in hybrid electric vehicle (PHEV) on or after 2010 qualify for this credit. See IRS Qualified Plug-In Electric Drive Motor Vehicles (IRC 30D) for the latest updates.

Type: Nonrefundable

Dates: This tax credit phases-out for vehicles from manufacturers that have sold more than 200,000

qualified vehicles for use in the United States determined on a cumulative basis for sales after December 31,

2009.*

Claim Process: File Form 8936, Qualified Plug-In Electric

Drive Motor Vehicle Credit with annual federal income tax returns in the year you purchased and began using

your electric vehicle.

*NOTE: Tesla and General Motors electric or hybrid vehicles do not qualify for the 2022 EV tax credit -- both manufacturers hit the 200,000 qualified vehicles limit. (i.e., The credit is not available for Tesla vehicles acquired after Dec 31, 2019 or General Motors vehicles acquired after Mar 31, 2020.)

This provision provides a federal production tax credit (PTC) for the sale of renewable electricity that is produced by certain renewable energy production property in the United States. The amount of the credit varies based on the production method and amount of energy produced and the reference price of the relevant fuel type

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8835, Renewable Electricity Production Credit with annual federal income tax returns.

This credit, technically a federal tax deduction, (also known as the "Commercial Building Energy-Efficient Tax Deduction") saves up to $1.88 per square foot and is available to building owners that purchase and install qualifying energy-efficient equipment. Tenants can also claim the credit if they make qualified construction expenditures to the building.

Type: Nonrefundable

Dates: No expiration (Permanent part of tax code)

Claim Process: To claim the deduction, building owners must obtain a certification and/or

allocation letter confirming the property meets all requirements and include this documentation with annual federal

income tax returns. Owners must use a certified software to calculate energy and consumption amounts. See 179D Commercial Buildings Energy-Efficiency Tax Deduction for a list of certified software.

Also known as the "Affordable Housing Credit" or "Housing Credit," this federal tax credit is an incentive for real estate developers and investors to build or renovate housing for low-income Americans. There are two types of Low-Income Housing tax credits that developers can leverage -- the 4% LIHTC, which is used in combination with tax-exempt private activity bonds, and the 9% LIHTC, which is used mostly for new construction projects.

The credit is calculated as 4% or 9% of the project’s qualified basis. Typically taken over a 10-year period, the transferrable credit is administered by state housing finance authorities. The credit can't exceed the amount allocated to the building and can only be claimed for residential rental housing projects that meet specific income requirements.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8586, Low-Income Housing Credit

with annual federal income tax returns.

This federal tax credit (also known as "New Markets Tax Credit (NMTC)") incentivizes economic growth and community development through the use of tax credits that attract private capital into low-income communities. The NMTC Program allows individual and corporate investors to receive a tax credit when they make investments in Community Development Entities (CDEs). The credit saves 39% of the initial investment amount and is claimed over a seven-year credit period.

Type: Nonrefundable

Dates: Dec 21, 2000 - Dec 31, 2025

Claim Process: File Form 8874, New Markets Credit with

annual federal income tax returns.

This federal tax credit (also known as "Rehabilitation, Energy & Reforestation Investment Credit," "Investment Credit" or "Historic Tax Credit (HTC)") provides a credit for 20% of the expenses incurred in renovating a historic building for business or for some income-generating use. The credit excludes building purchase costs and you must take the 20% credit spread out over five years, starting in the year you placed the building into service.

Taxpayers who own an interest in the historic building, or are lessees of the building in some cases, are eligible to claim this credit. Pass-through entities cannot claim the credit but their partners, members, shareholders and beneficiaries are eligible, as are individuals, corporations, estates and trusts. See IRS Rehabilitation Credit FAQs for more details.

Type: Refundable

Dates: No expiration currently defined

Claim: File Form 3468, Investment Credit with annual federal income tax returns.

Businesses are eligible for this federal credit if they spend money to make their building more accessible for employees, customers and other individuals with disabilities. The credit covers 50% of expenses, up to $10,250. See Tax Benefits for Businesses Who Have Employees with Disabilities for further details.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: Calculate eligible access expenses using IRS Form 8826, Disabled Access Credit and

file with annual federal income tax returns.

An Opportunity Zone is a federally designated low-income area that offers tax incentives for investment in qualified local businesses and property. Also called a "Qualified Opportunity Zone" or "QOZ," they were created by the 2017 Tax Cuts and Jobs Act (TCJA) to encourage long-term, private investment in economically distressed communities. See Opportunity Zones for more details.

Type: Nonrefundable

Dates: Dec 31, 2047 is the final date to dispose of an opportunity zone investment.

Claim Process: An eligible corporation or partnership annually files Form 8996, Qualified Opportunity Fund

with its federal income tax return.

This federal tax credit saves 25% of qualified clinical testing expenses paid or incurred during the tax year. This credit incentivizes pharmaceutical companies to develop drugs and treatments for rare diseases that don't affect enough people for the company to make a profit on the sales of those medications and treatments.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8820, Orphan Drug Credit with

annual federal income tax returns.

The Research and Development (R&D) tax credit, also known as the "Increasing Research Activities Credit" and "Research and Experimentation (R&E) Credit" is a federal business tax credit that helps companies that have spent money on research and development recoup some of these costs, including expenditures on the development, design or improvement of products, processes, formulas, patents, techniques or software.

This federal tax credit could save up to $250,000 in payroll taxes. To be eligible, the business needs to engage in what the IRS calls qualified research expenditures, or QREs. In its most basic form, the R&D tax credit covers 5% to 15% of qualified research expenditures. Gross receipts for the year in question will need to be lower than $5 million, and you can’t have gross receipts from more than five years ago.

Note: The maximum allowable payroll credit election remains at $250,000 for tax years December 31, 2015 to December 31, 2022.

Type: Nonrefundable

Dates: No expiration (Permanent part of tax code)

Claim Process: File Form 6765, Credit for Increasing Research

Activities with annual federal income tax return.

This federal tax credit is part of the general business credit and is figured by multiplying the number of cases of bottled distilled spirits purchased or stored during the tax year by the average tax-financing cost per case for the most recent calendar year ending before the beginning of the tax year.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: Partnerships and S Corporations must file Form 8906, Distilled Spirits Credit with annual federal income tax returns. All other

taxpayers report this credit directly on line 1n in Part III of Form 3800, General Business Credit.

See form instructions for exceptions.

Also called the “45G Tax Credit,” this federal tax credit grants an amount equal to 50% of qualified track maintenance expenditures and other qualifying railroad infrastructure projects for short lines and regional railroads across the U.S.

Type: Nonrefundable

Dates: Effective through Dec 31, 2022

Claim Process: File Form 8900, Qualified Railroad Track Maintenance Credit with annual federal income tax

returns.

Have you claimed savings for ALL tax credits for which your business is eligible? Whether you’re investing in research, hiring new employees, expanding geographic reach, or making improvements to current location, your bottom line could be boosted with tax credit savings.

Many business tax credits are available at both state and federal levels, providing stacked savings opportunities. Planning for these credits is crucial, as some deadlines are time sensitive and triggered based on actions like hiring employees or selecting a specific location to move your business.

Don’t miss out. Take advantage of all eligible tax credits for your business and significantly reduce the taxes you owe to the government. Our business tax experts can help you identify federal and state credits and complete the claim process, so you can reinvest tax savings for sustaining and growing your business.

For assistance with claiming business tax credits, see our tax credit services.

Armanino has the industry expertise, tax credit experience and track record of customer satisfaction to best advise your tax credit incentive strategy and compliance needs.

Contact us today for a free assessment.